| Oracle® Communications Data Model Reference Release 11.3.2 E28440-05 |

|

|

PDF · Mobi · ePub |

| Oracle® Communications Data Model Reference Release 11.3.2 E28440-05 |

|

|

PDF · Mobi · ePub |

This chapter provides Oracle Communications Data Model reports.

Note:

Some of the reports shown may appear incomplete. The sample reports shown use manually generated data, and for data privacy and regulatory reasons, it shows only made up customers (with real data). Hence, if you notice data inconsistency between the reports, this is not due to Oracle Communications Data Model, but due to the sample data.The reports shown in this chapter appear as shown when you install Oracle Communications Data Model with the sample data.

This chapter includes the following sections:

The customer management reports include the following areas:

This area includes the reports: Customer Acquisition, and Customer Acquisition Forecast.

This report, as shown in Figure 12-1 provides the yearly and monthly number of customers to be acquired compared with actual customers acquired by product and with respective to customers type. All time transformation variation of Customer Acquisition numbers are displayed, including Last Year (LY) and Year to Date (YTD). Users can select certain products, organizations, and customer's type to narrow down the customer numbers.

Report dimensions are:

Business Time

Product Spec

Customer Type

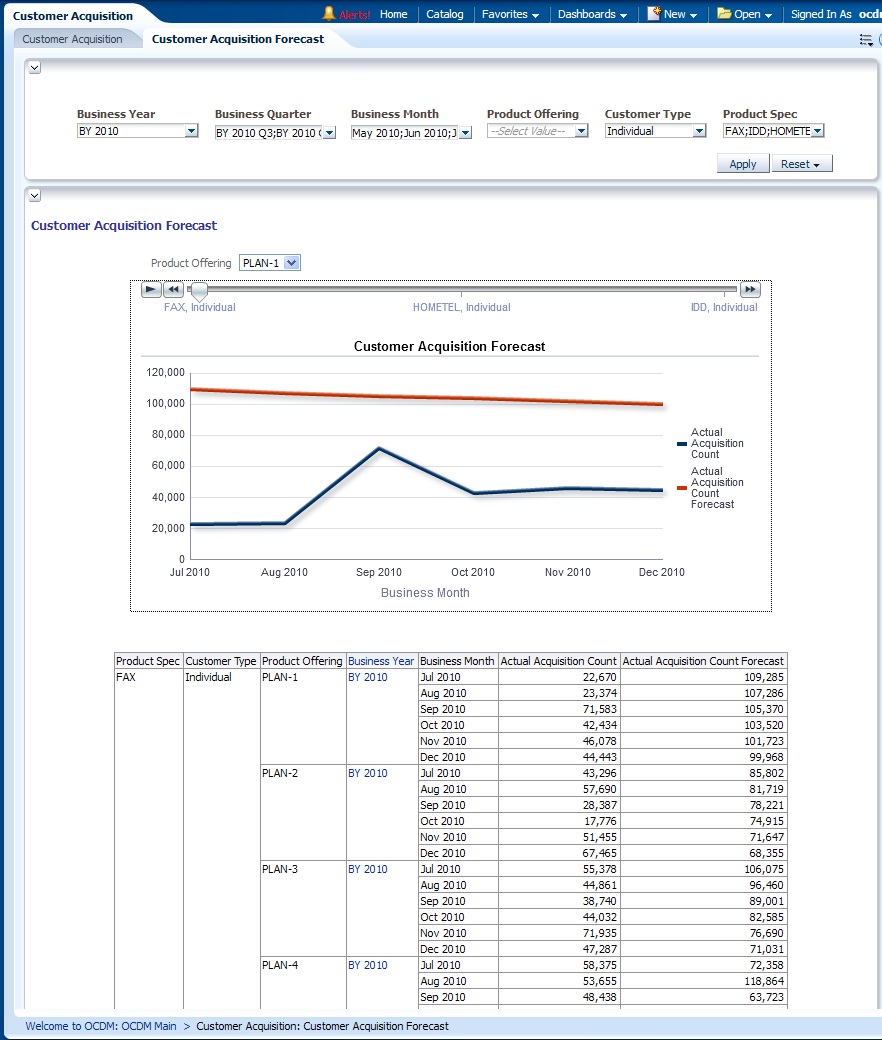

This report, as shown in Figure 12-2 provides the yearly and monthly level forecasting of customers count to be acquired versus the actual customers acquired by product offering and customers type.

Report dimensions are:

Business Time

Product Offering

Customer Type

Product Spec

Figure 12-2 Customer Acquisition Forecast Report

This area includes the reports: Customer Growth Rate and Customer Growth Trend Forecast.

This report, as shown in Figure 12-3 provides the yearly and monthly customer count and revenue growth rate over products and geographical boundaries

Report dimensions are:

Business Time

Organization

Customer Type

Product Specification

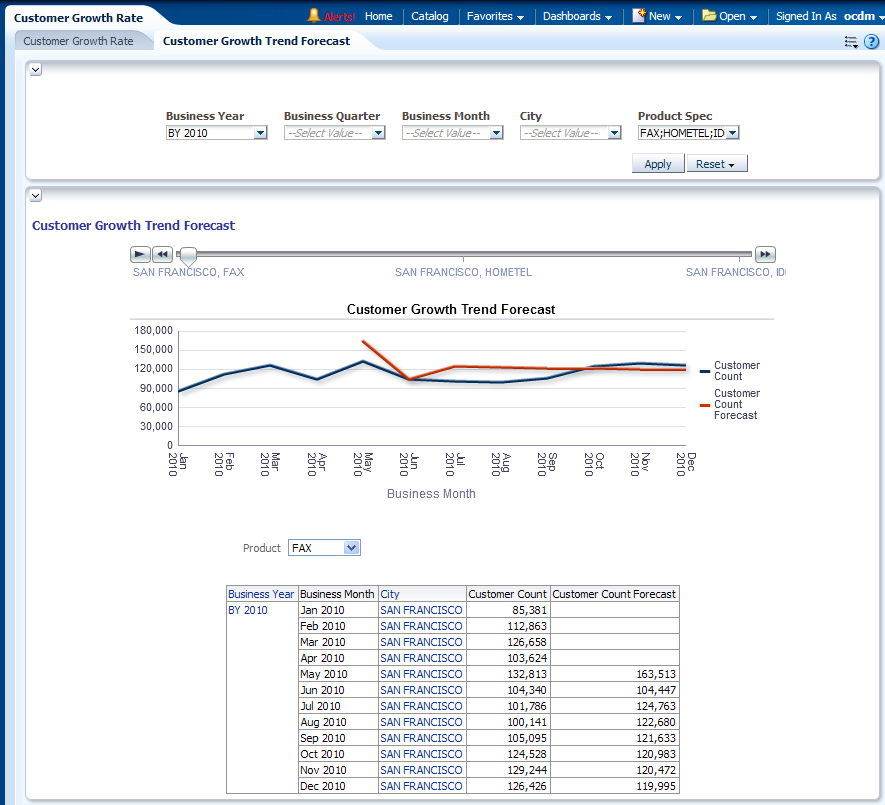

This report as shown in Figure 12-4 provides the month level number of customers for organization, products, and geographical boundaries. The future number of customers forecast for the next six months, or twelve months, can be forecast by Oracle OLAP forecast settings.

Report dimensions are:

Business Time

Product Specification

Geography

Figure 12-4 Customer Growth Trend Forecast Report

This area includes the reports: Customer Segments, Customer Segmentation Details, Churn by Customer Segments, and Churn Predict by Customer Segment.

This report, as shown in Figure 12-5 shows customer segments.

This report displays the customer segmentation model result. The customer segmentation model groups customers into ten segments according to how similar they are to each other. The similarity is calculated based on customer demographic value (education, income, and so on), usage pattern and list of telecom products they subscribe to (customer subscriber history). The grouping rules are derived automatically by K-Means algorithm implemented inside Oracle Database. Business Analysts can look into each segment to further understand the customer group discovered by the algorithm and name each segments.

By default, the summary information about each segment is displayed in the bottom table. For each segment, the Average Contract Value, Avg Debt Value, and Avg monthly revenue (in last 6 months) are displayed. Those three values are depicted in three pie charts above the table respectively, to show the distribution among customer segments.

The prompt "SVM Predict Churner Indicator" can be used to filter the customer. If user select "1", then for each segment, only those customer who were predicted as "churner" by SVM churn model is counted in. Then the number would be less than all customers in the segment.

Similarly, "DT Predict Churner Indicator" can filter customers to be only those who were predicted as "churner" by Decision Tree churn model

Note: This groups all the customers, not only churners.

Report dimensions are:

Customer

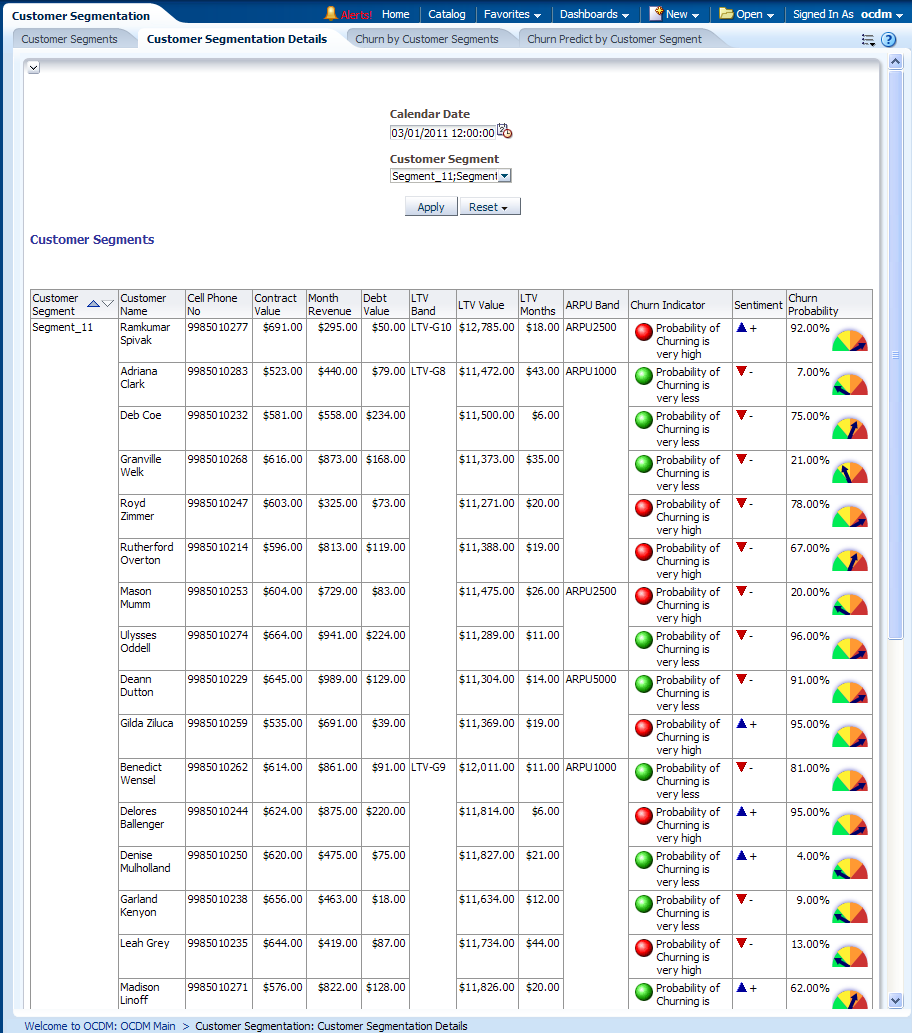

This report, as shown in Figure 12-6 provides the customer segmentation details on basis of certain customer statistical metrics such as contract value, month revenue, debt value and so on.

For the given customer, the report also displays the contract value, month revenue, debt value and so on. In fact, the end user can easily extend this report by adding any relational aggregated information about the customer into this report. For example, number of calls, number of complaints, and so on. They can use BIEE Answers to add those additional measures into the report.

Report dimensions are:

Customer

Figure 12-6 Customer Segmentation Details Report

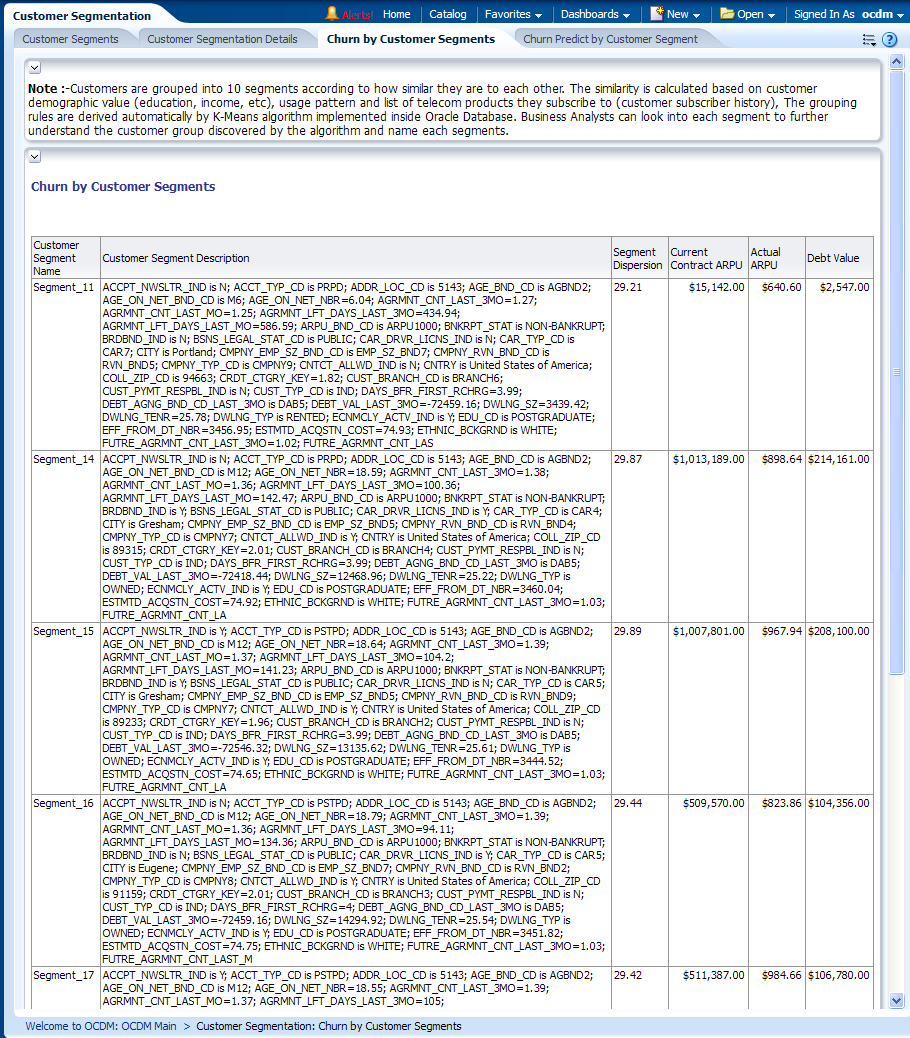

This report, as shown in Figure 12-7 shows customer segments.

This report displays the customer segmentation model result. The customer segmentation model groups customers into ten segments according to how similar they are to each other. The similarity is calculated based on customer demographic value (education, income, and so on), usage pattern and list of telecom products they subscribe to (customer subscriber history). The grouping rules are derived automatically by K-Means algorithm implemented inside Oracle Database. Business Analysts can look into each segment to further understand the customer group discovered by the algorithm and name each segments.

Report dimensions are:

Customer

Figure 12-7 Customer Segmentation Churn by Customer Segments Report

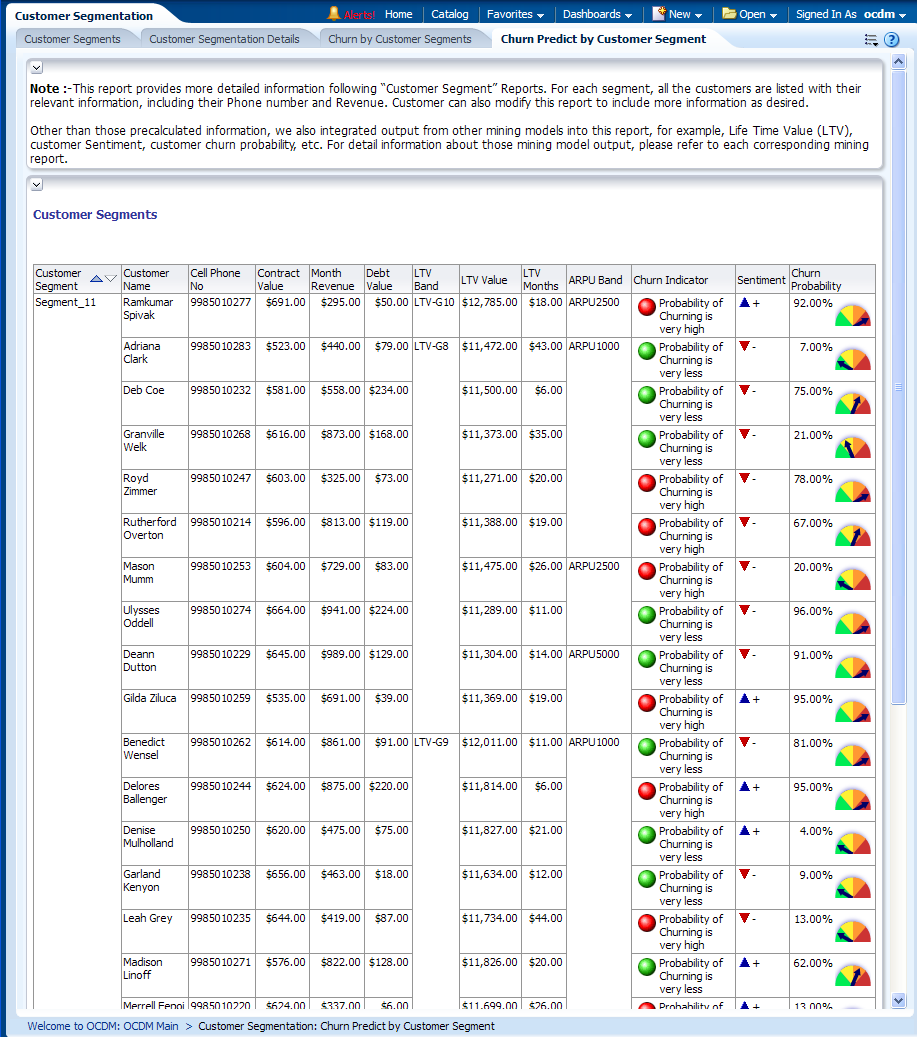

This report, as shown in Figure 12-8 shows customer segments.

This report displays the customer segmentation model result. The customer segmentation model groups customers into ten segments according to how similar they are to each other. The similarity is calculated based on customer demographic value (education, income, and so on), usage pattern and list of telecom products they subscribe to (customer subscriber history). The grouping rules are derived automatically by K-Means algorithm implemented inside Oracle Database. Business Analysts can look into each segment to further understand the customer group discovered by the algorithm and name each segments.

Report dimensions are:

Customer

Figure 12-8 Churn Predict by Customer Segment Report

This area includes the reports: Customer Life Time Value, Customer by Life Time Value Band, Customer by Life Time Span Category, and Customer Life Time Span Detail.

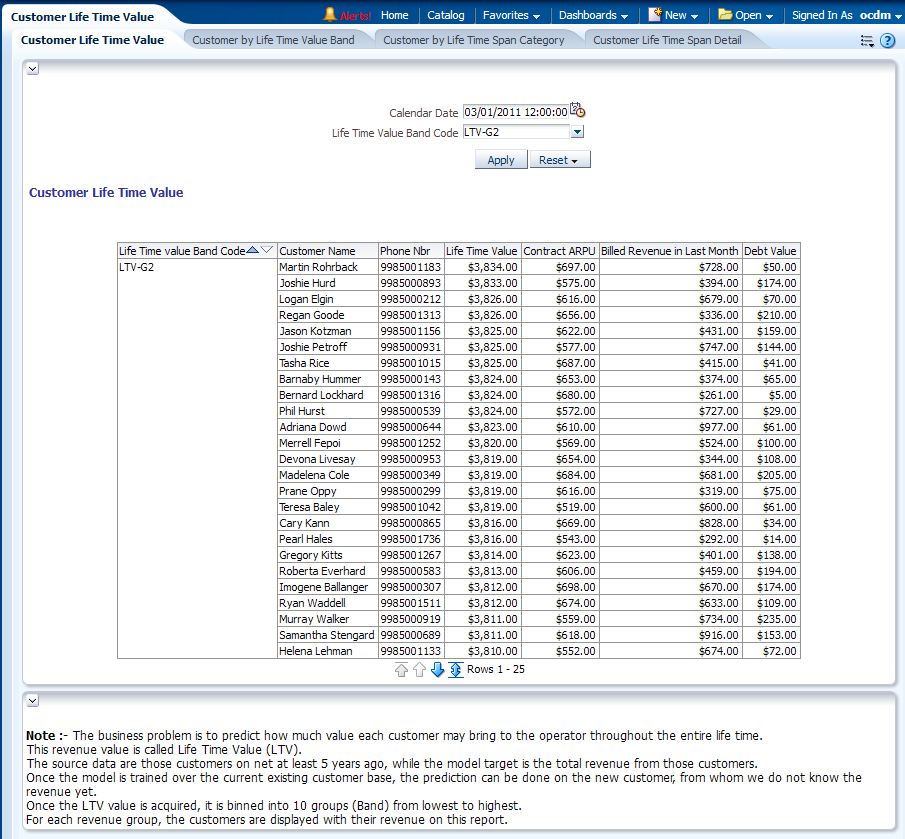

This report as shown in Figure 12-9 provides the predicted Life Time Value (LTV) for all customers grouped by LTV Band Code. It also shows some additional aggregated information about the customer.

Report dimensions are:

Customer

Customer Mining

Figure 12-9 Customer Life Time Value Report

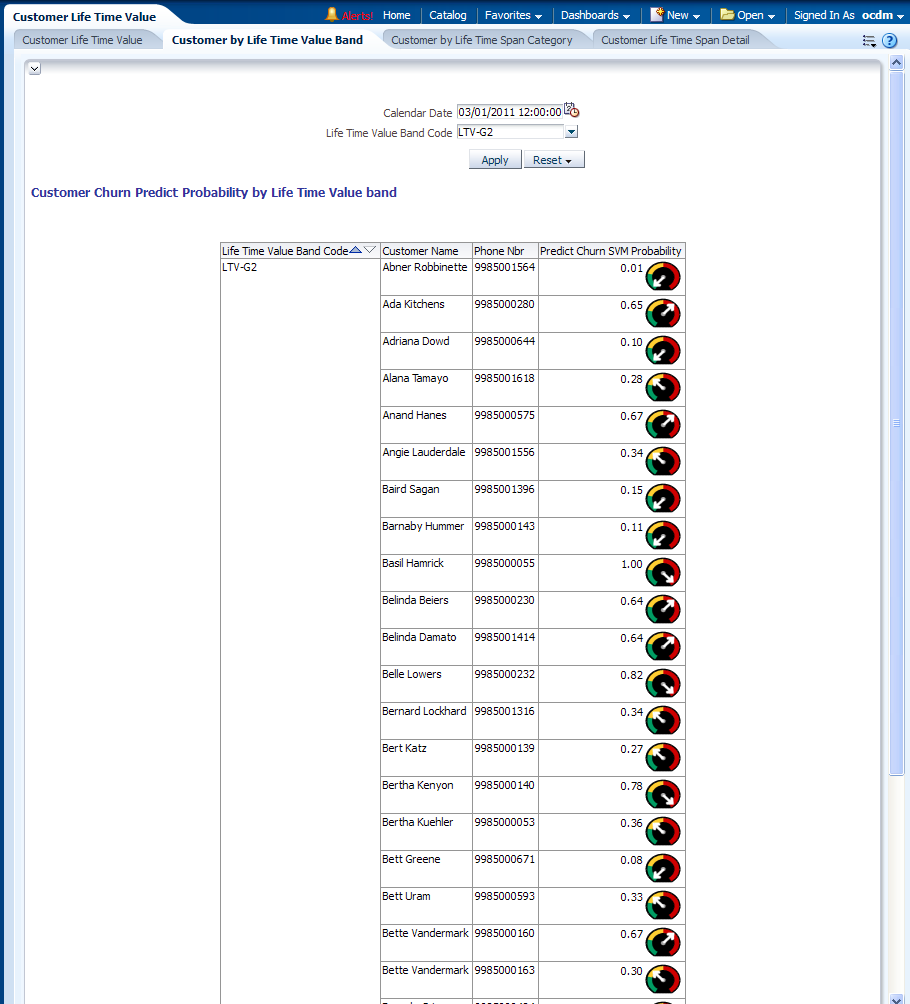

This report, as shown in Figure 12-10 provides the churn prediction result for the customers belonging to a certain Life time Value Band (that is, the customers likely to be with the service provider compared with the customers that already left the service provider.)

Report dimensions are:

Customer

Customer Mining

Figure 12-10 Customer by Life Time Value Band Report

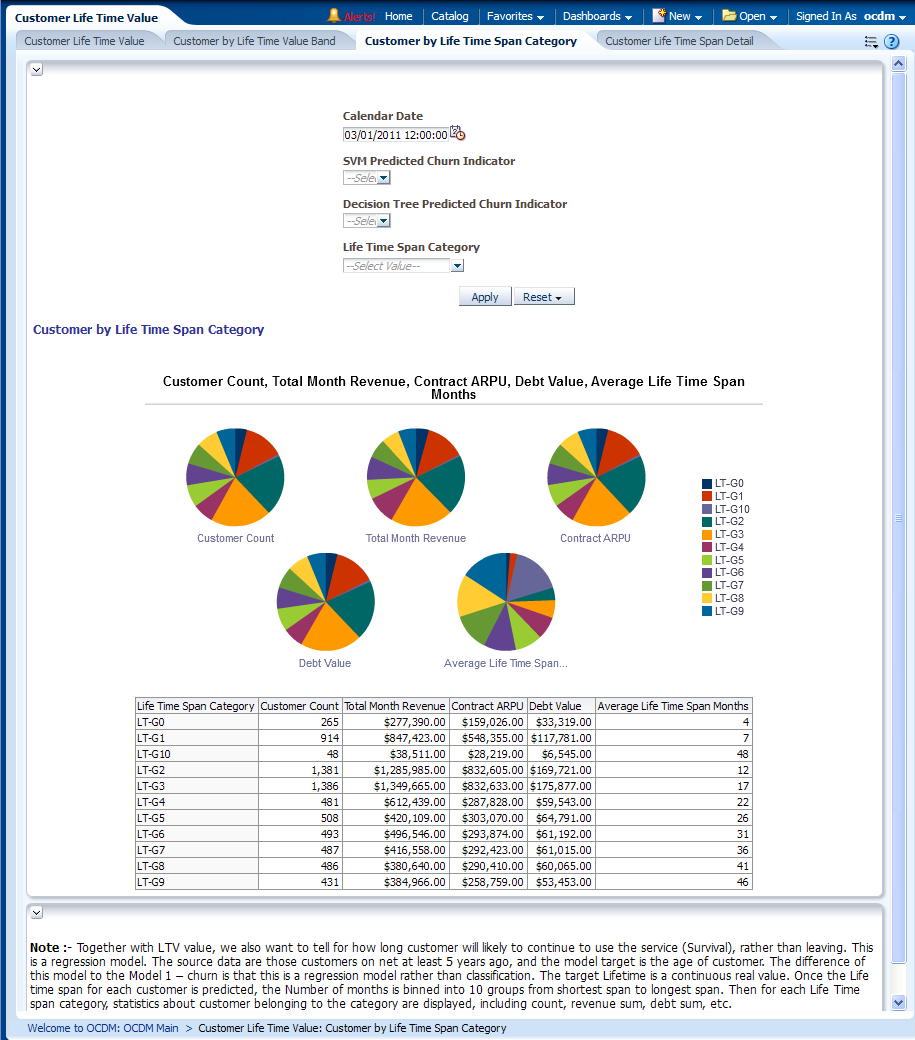

This report, as shown in Figure 12-11 provides the customer life time span with the service provider on the basis of certain mining metrics such as average life time span months, total month revenue, contract Average Revenue Per User (ARPU) and so on. The Life time span value is measured by Months, therefore, a value of "22" in "Avg Life Time Span Months" means the customer is very likely to use the services for at least 22 months. The customers are binned into Life Time Span Category according to the value of Life time span.

Report dimensions are:

Customer

Customer Mining

Figure 12-11 Customer by Life Time Span Category Report

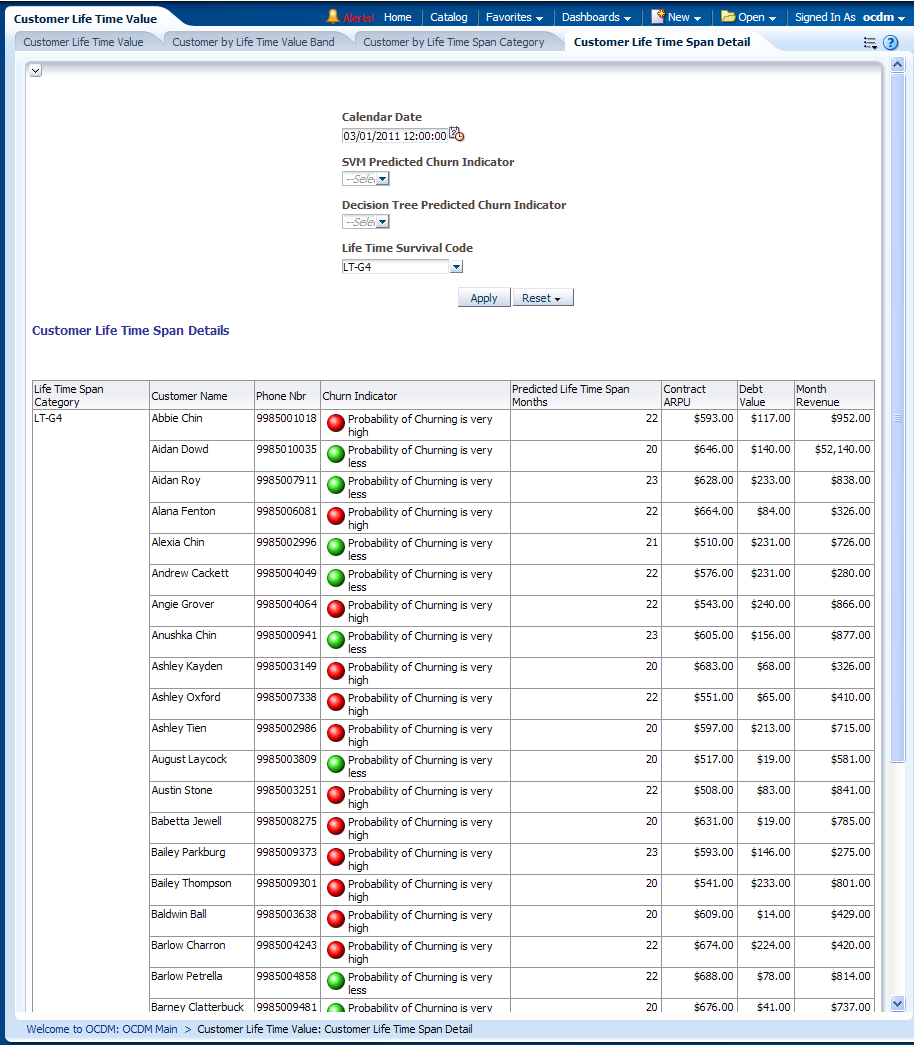

This report, as shown in Figure 12-12 provides more information about the customers in each life time span category.

Report dimensions are:

Customer

Customer Mining

Figure 12-12 Customer Life Time Span Detail Report

This area includes the reports: Customer Churn Rate, Customer Churn Statistics, Churn Reason Distribution, Churn Outlier by Site (Building), Churn Outlier by Sales Agent, and Complain Rate Outlier by Business Unit.

This report, as shown in Figure 12-13 provides year-level churn rate information of an organization based on Customer type. It also shows the Last year information for the user to see differences.

Report dimensions are:

Organization

Business Time

Customer

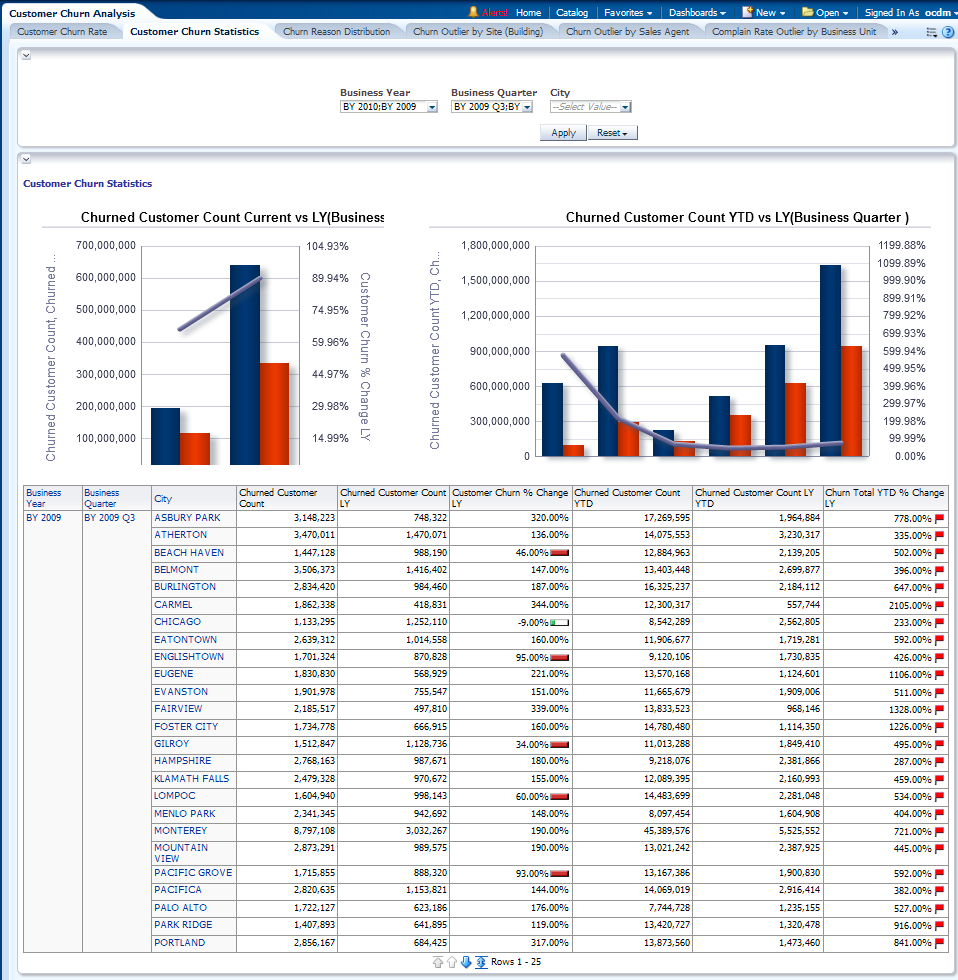

This report, as shown in Figure 12-14 provides year-level subscription performance based on churn statistics relating to a Customer, such as high churn rate analysis for a subscription, and so on. Oracle Communications Data Model provides certain operational measures such as forecasting, prediction, and so on, to over come this problem This data can be analyzed with LY and YTD data.

Report dimensions are:

Organization

Business Time

Customer

Figure 12-14 Customer Churn Statistics Report

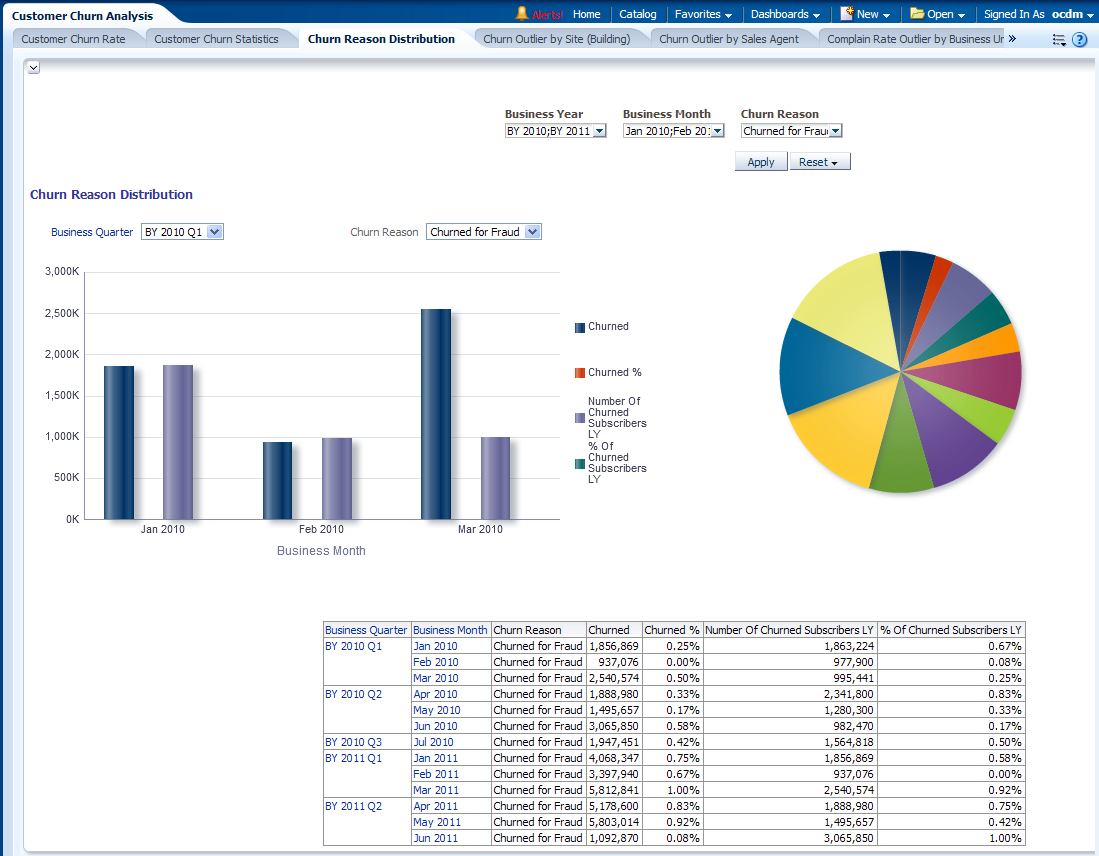

This report as shown in Figure 12-15 identifies the year level top reasons that lead the customers to move out of the service providers. It also gives the flexibility to compare the same with last year churn information. Thus, it gives the service providers a way to analyze the churn situation according to customer stated churn reasons.

Report dimensions are:

Business Time

Churn Reason

Figure 12-15 Churn Reason Distribution Report

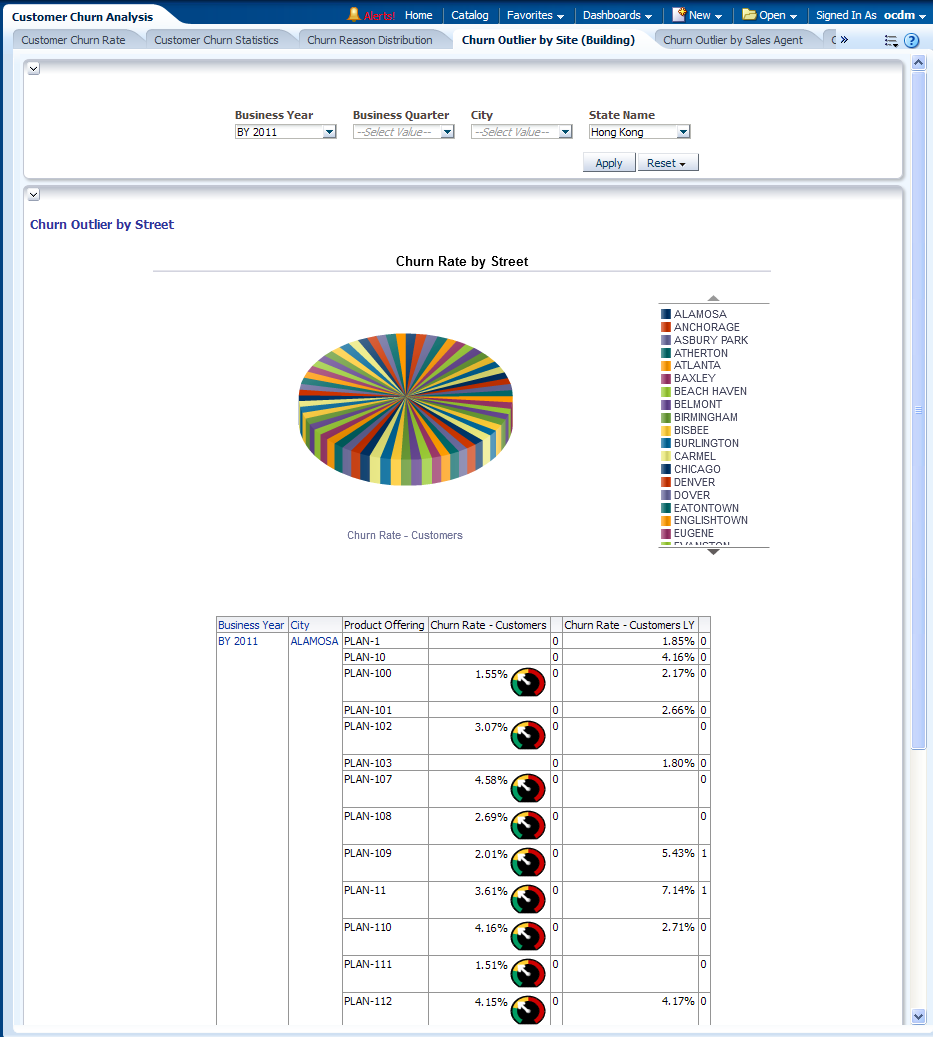

This report, as shown in Figure 12-16 mainly speaks about the broadband or Fix Line related churn analysis pertaining to one building or an area. The churn rates are displayed for all building in selected area, and those extremely high churn rates are identified as “Churn Outlier” beside the churn rate, marked by number “1” and background as RED.

It can help identify the churn related problem such as network problems, arrival of new competitors, and so on. For example, when competitors launch a promotion or your network fails, the churn rate may go up. This report can help identify the problem before revenue loss occurs.

Report dimensions are:

Business Time

Geography

Product Offering

Figure 12-16 Churn Outlier by Site (Building) Report

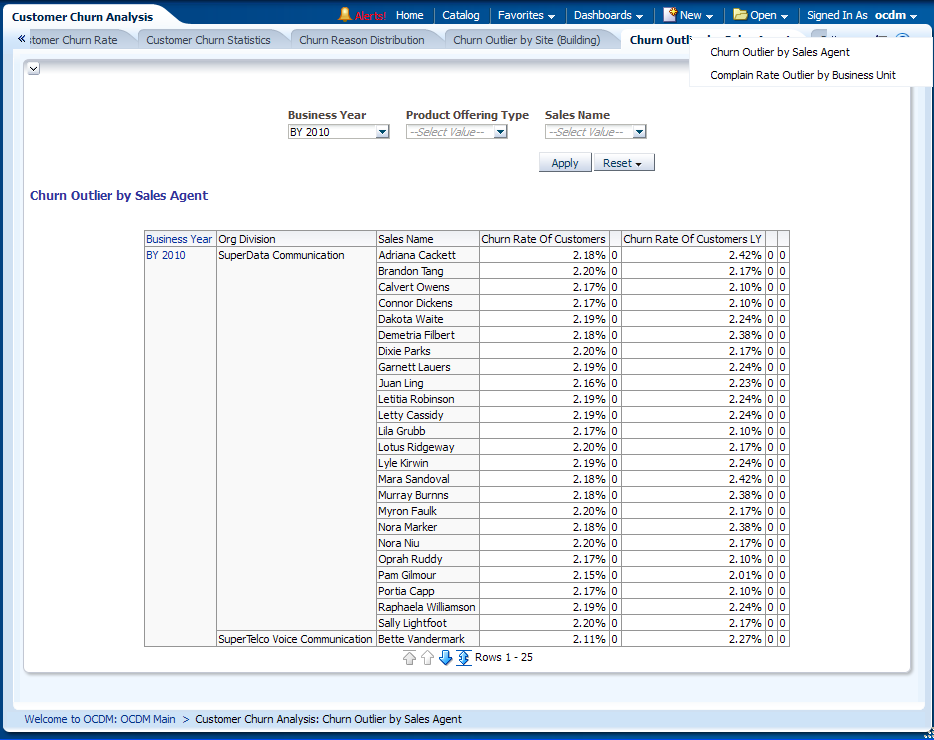

This report, as shown in Figure 12-17 identifies the extremely high churn rate in the customers brought in by certain sales representative agents. For example, the sales agent may introduce the package to those incapable of paying the bill, or to his friends who churn right after acquiring the promotion gifts. Thus it enables a service providers to identify fraud cases by sales agents.

Report dimensions are:

Business Time

Organization

Product Offering Type

Sales Channel Representative

Figure 12-17 Churn Outlier by Sales Agent Report

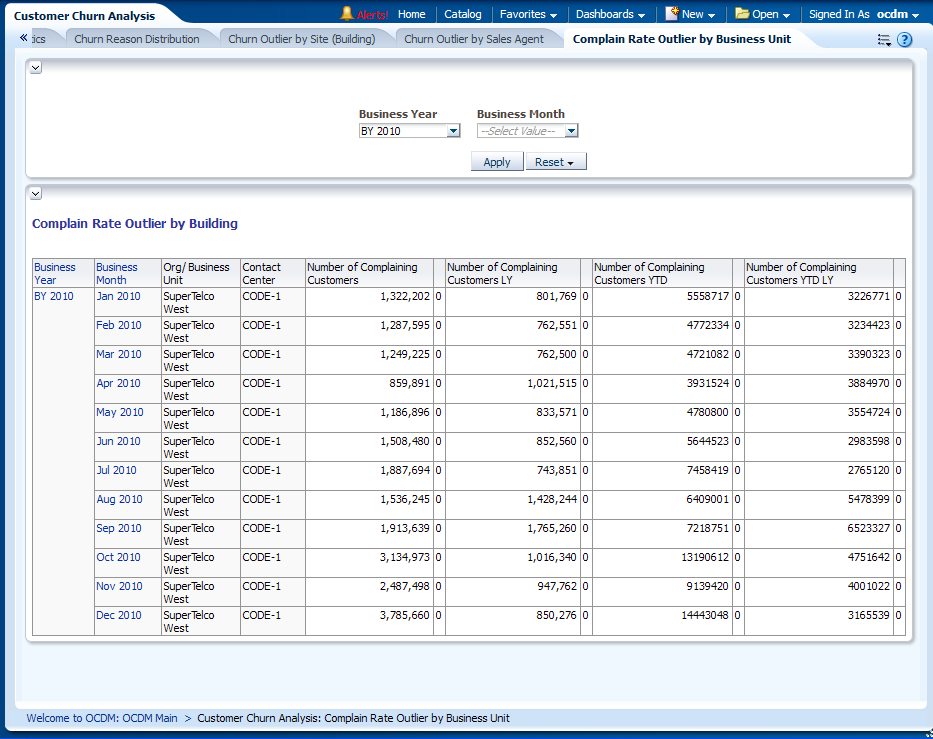

This report, as shown in Figure 12-18 works in the same way as the report “Churn Outlier by Building”. However, instead of detecting a high churn rate, which already incurred revenue loss, this report tries to identify those areas where an extremely high compliant rate is observed. The report also shows the complaint rate in LY, YTD and LY YTD.

Report dimensions are:

Business Time

Figure 12-18 Complain Rate Outlier by Business Unit

This area includes the reports: Retention Cumulative Gain, Prepaid Customer Churn Factor Rank, Postpaid Customer Churn Factor Rank, Predicted Churn Customer Report by Revenue Band, Churn Profile DT (Decision Tree) Rule, and Churn Prediction by (SVM result).

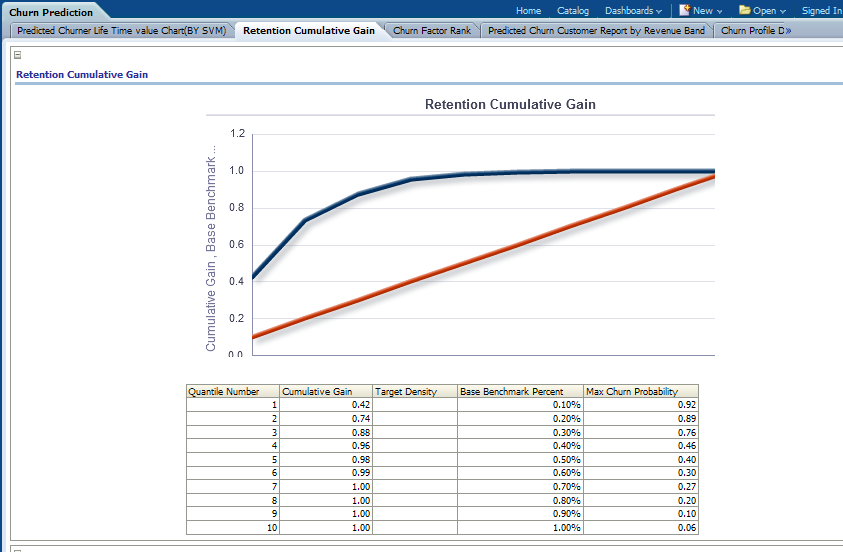

This report as shown in Figure 12-19 shows the Oracle Communications Data Model Churn prediction Model performance; this helps you determine a threshold for the percent of customers to run in the retention program. This retention can be done using phone calls or email. For example, according to the details in Figure 12-19, if the service provider selects 20% of MOST Likely churners according to the Oracle Communications Data Model Churn Prediction model, they can cover about 74% of real churners.

The chart here shows the accuracy of customers so identified under retention program prediction rather than picking on random selection of customers (shown as a straight line).

Report dimensions are:

Churn SVM ROC

Figure 12-19 Retention Cumulative Gain Report

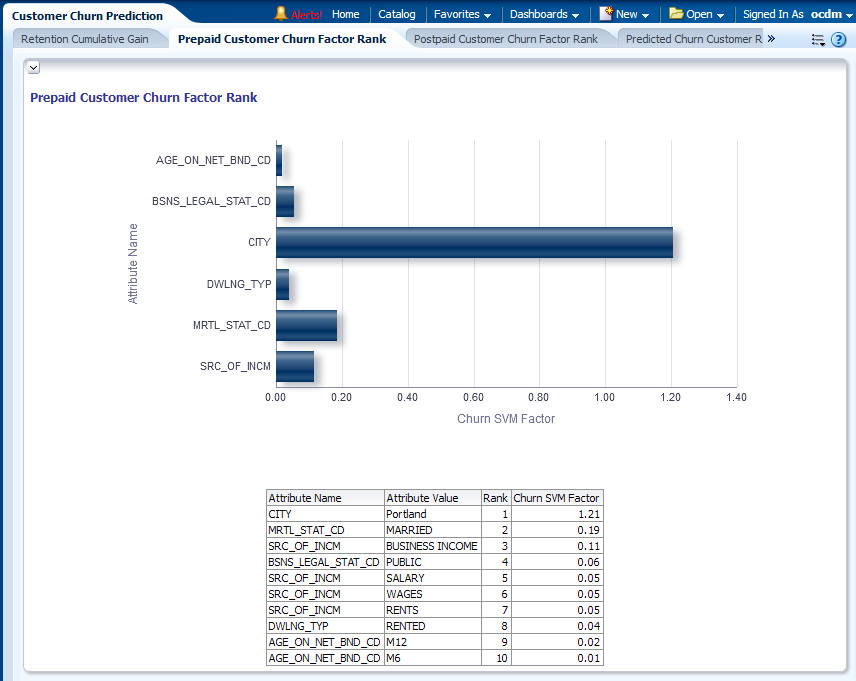

This as shown in Figure 12-20 can help you understand which attribute is more important in determining a prepaid customer churning pattern. The factors are ranked according to the SVM Coefficients from the Churn prediction model. The chart can help marketing understand the customers for a better campaign strategy.

Report dimensions are:

Churn SVM ROC

Figure 12-20 Prepaid Customer Churn Factor Rank Report

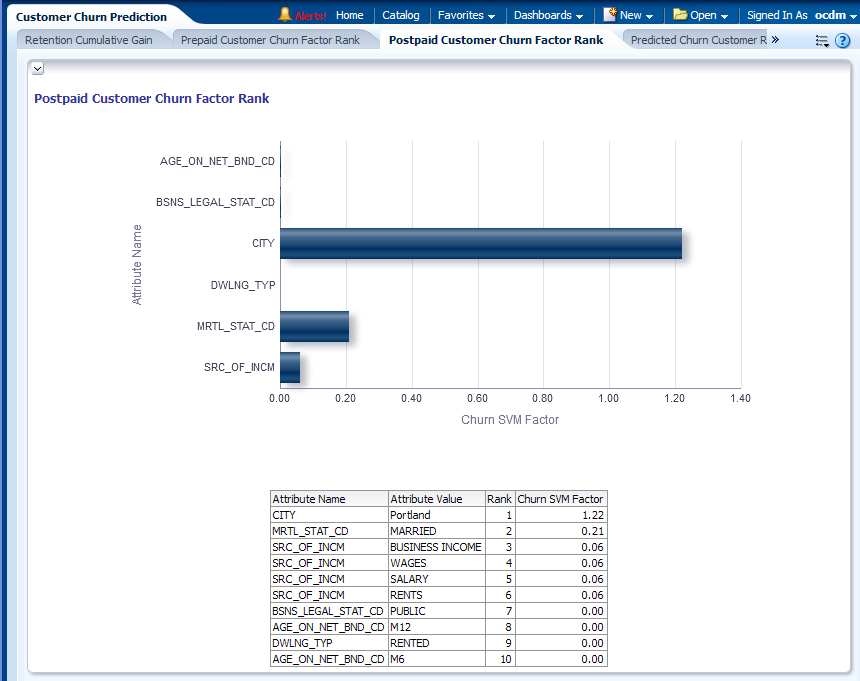

This as shown in Figure 12-21 can help you understand which attribute is more important in determining a postpaid customer churning pattern. The factors are ranked according to the SVM Coefficients from the Churn prediction model. The chart can help marketing understand the customers for a better campaign strategy.

Report dimensions are:

Churn SVM ROC

Figure 12-21 Postpaid Customer Churn Factor Rank Report

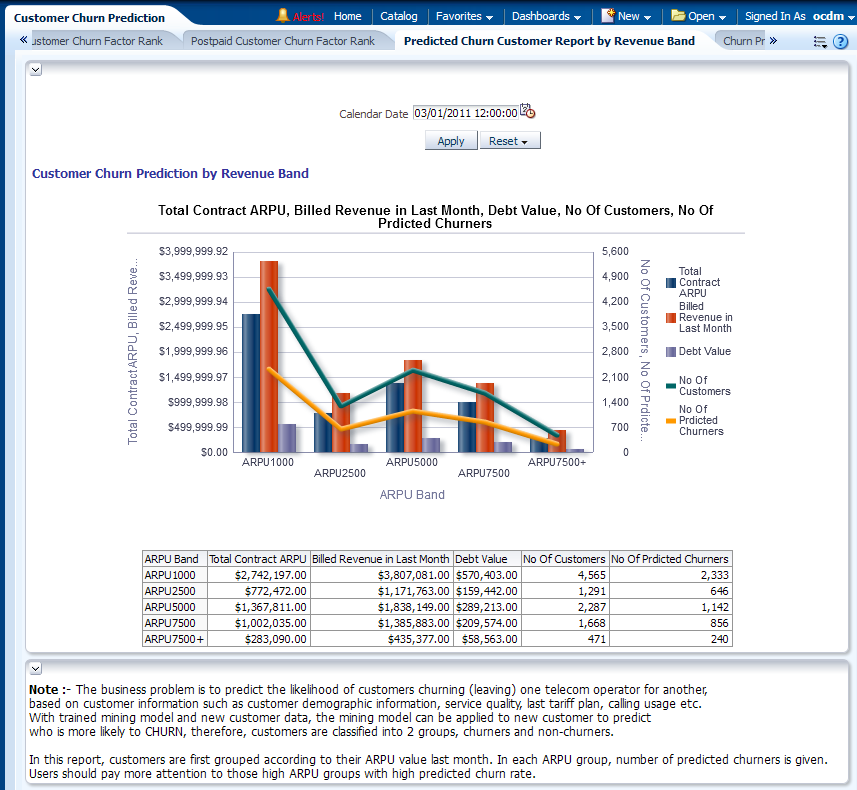

This report, as shown in Figure 12-22 shows the summary of customers and the summary of who may churn in the next month. The customers are binned into ARPU Band according to their last month revenue ARPU. In each ARPU band, the total revenue, debt value and Number of Predicted churners are displayed.

You can drill down into each ARPU band by clicking the ARPU band to see a customer list belonging to that ARPU band.

Report dimensions are:

ARPU Band

Figure 12-22 Predicted Churn Customer Report by Revenue Band Report

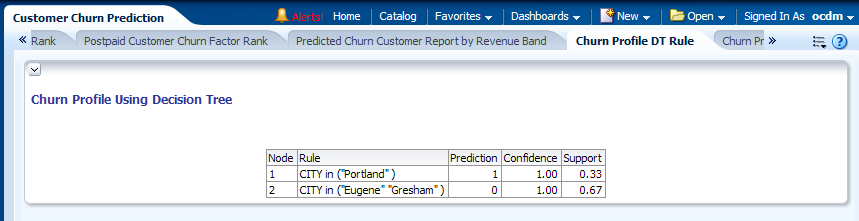

This report as shown in Figure 12-23, mainly speaks about the customers churn profiling for each Decision Tree node generated by the decision tree Churn Prediction model.

Figure 12-23 Churn Profile DT (Decision Tree) Rule Report

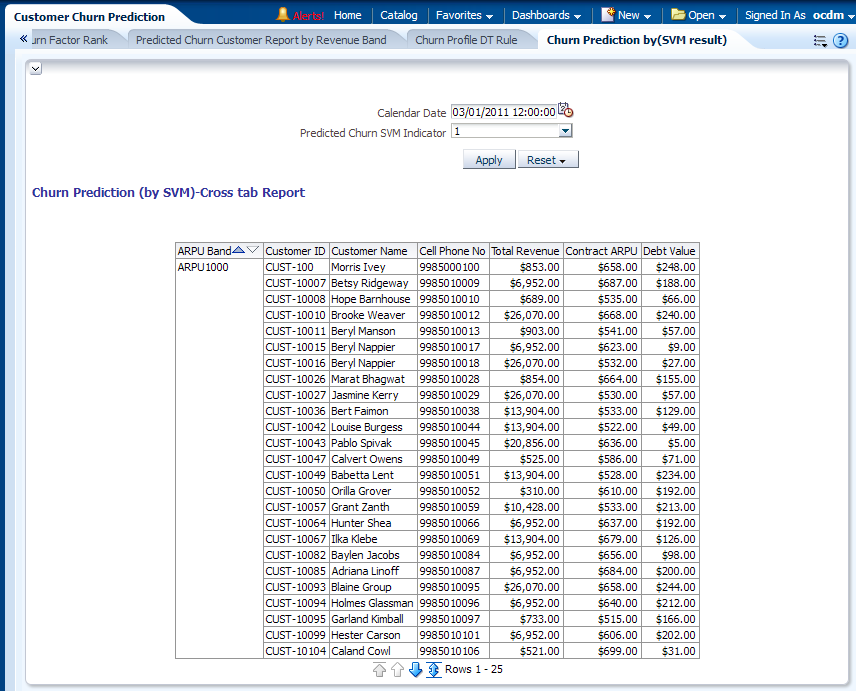

This as shown in Figure 12-24, identifies the patterns of customers churning (leaving) based on customer information such as customer demographic information, service quality, last tariff plan, calling usage, and other factors. Base lining on these patterns, the model can also do the calculation over current customer base (called 'Apply') to predict who the customers are mostly like to churn in next few months. With these predictions, operators can initiate certain retention programs to reduce the customer churn rate.

Report dimensions are:

Business Time

Organization

Customer

Figure 12-24 Churn Prediction by (SVM Result) Report

The revenue reports show the following areas:

This area includes the reports: Monthly Revenue, Revenue Forecast, Average Revenue per User (ARPU), and Average Revenue per Employee.

This report, as shown in Figure 12-25 provides month-level transaction activity information based on revenue measures, for one or more organizations and products and for one or more locations.

Report dimensions are:

Business Time

Customer Type

Product Specification

Geography

Organization

This report, as shown in Figure 12-26 provides month-level transaction activity information based on revenue measures, for one or more locations.

Report dimensions are:

Business Time

Customer Type

Product

Geography

Organization

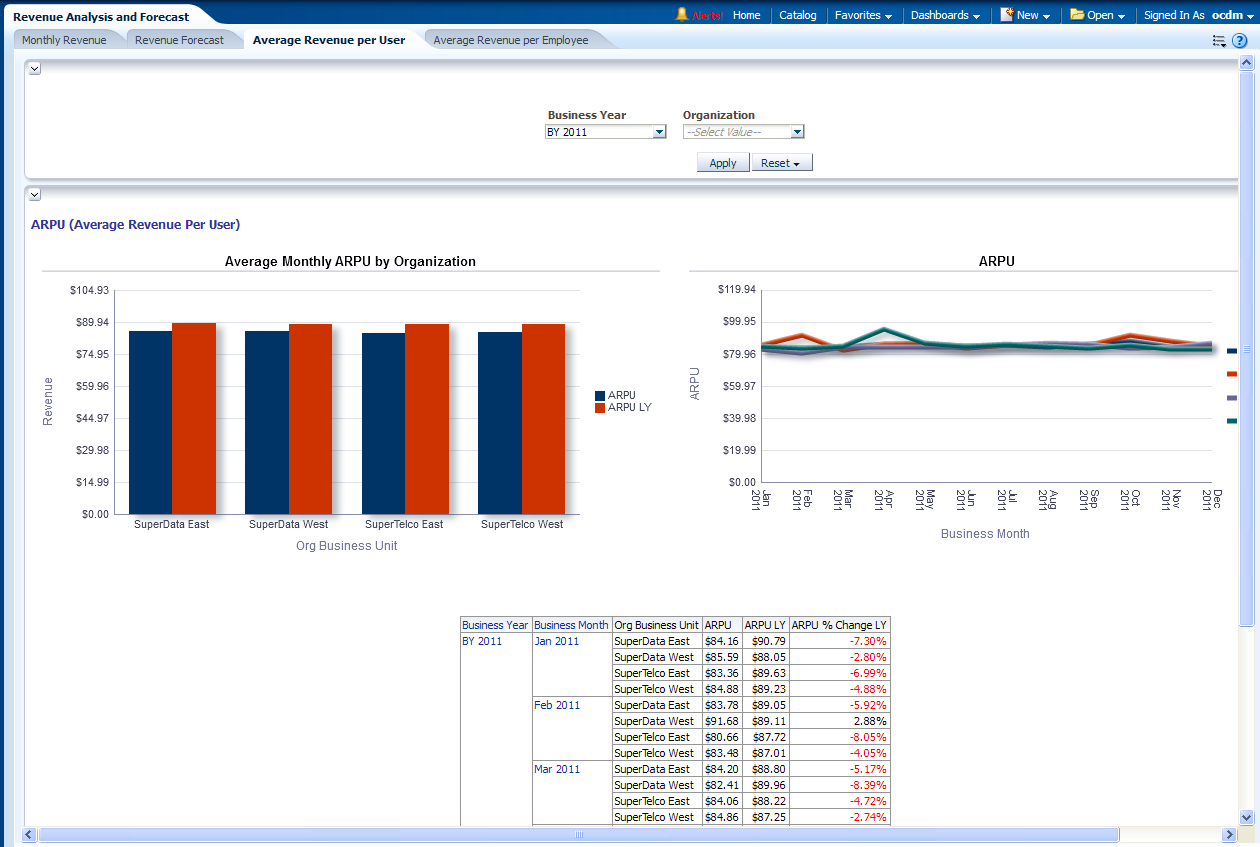

This report, as shown in Figure 12-27 provides month-level transaction activity information based on ARPU measures, for one or more stores and this is a calculation often used to determine the overall value of an application. This report used to generate revenue for a particular customer by comparing someone's account to the overall average.

Report dimensions are:

Business Time

Organization

Figure 12-27 Revenue Average Revenue per User (ARPU) Report

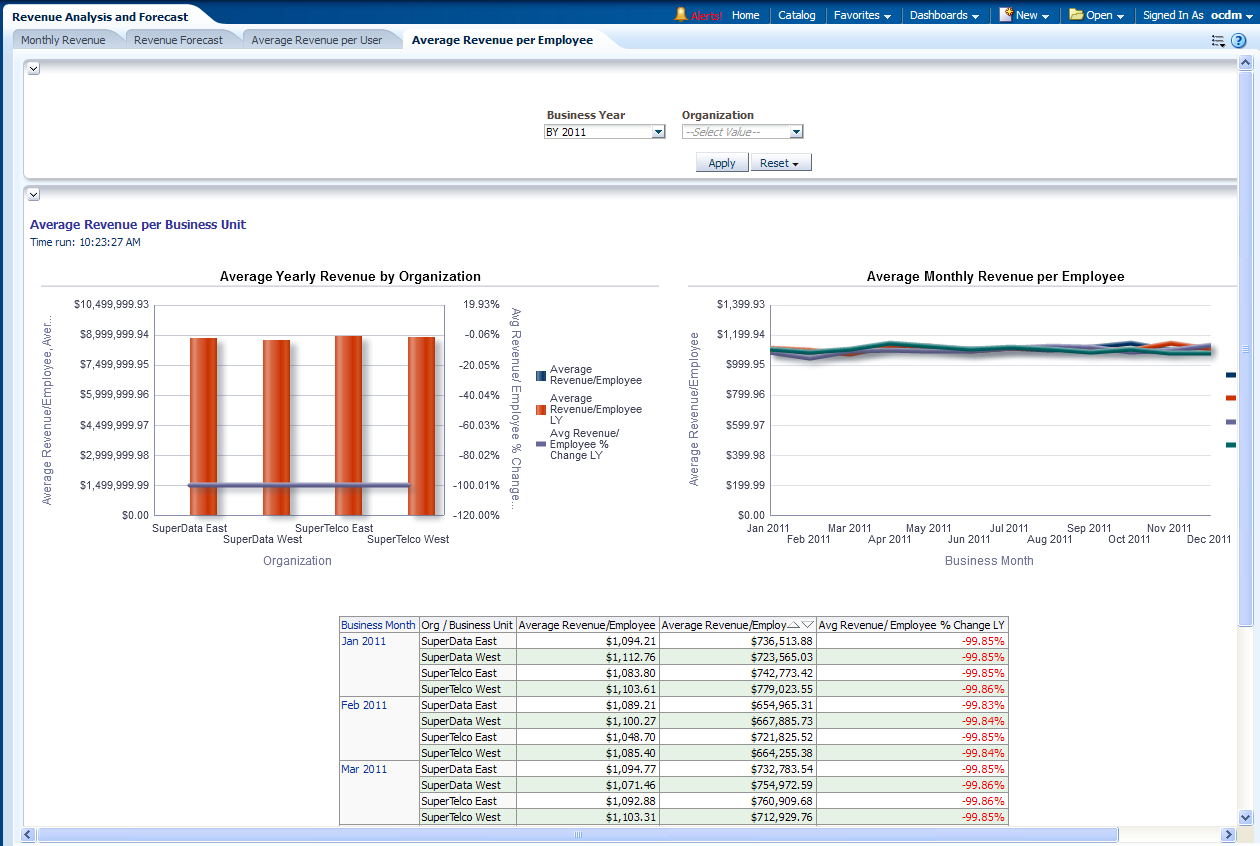

This report, as shown in Figure 12-28 shows the average revenue per Business Unit. The average revenue is calculated as total revenue of that organization divided by the number of employees.

Report dimensions are:

Business Time

Organization

Figure 12-28 Revenue Average Revenue per Employee Report

This area includes the reports: CDR Revenue Compared to Collected Revenue, Percent of Suspended xDRs, Uncollected Revenue Percentage, and Revenue Assurance.

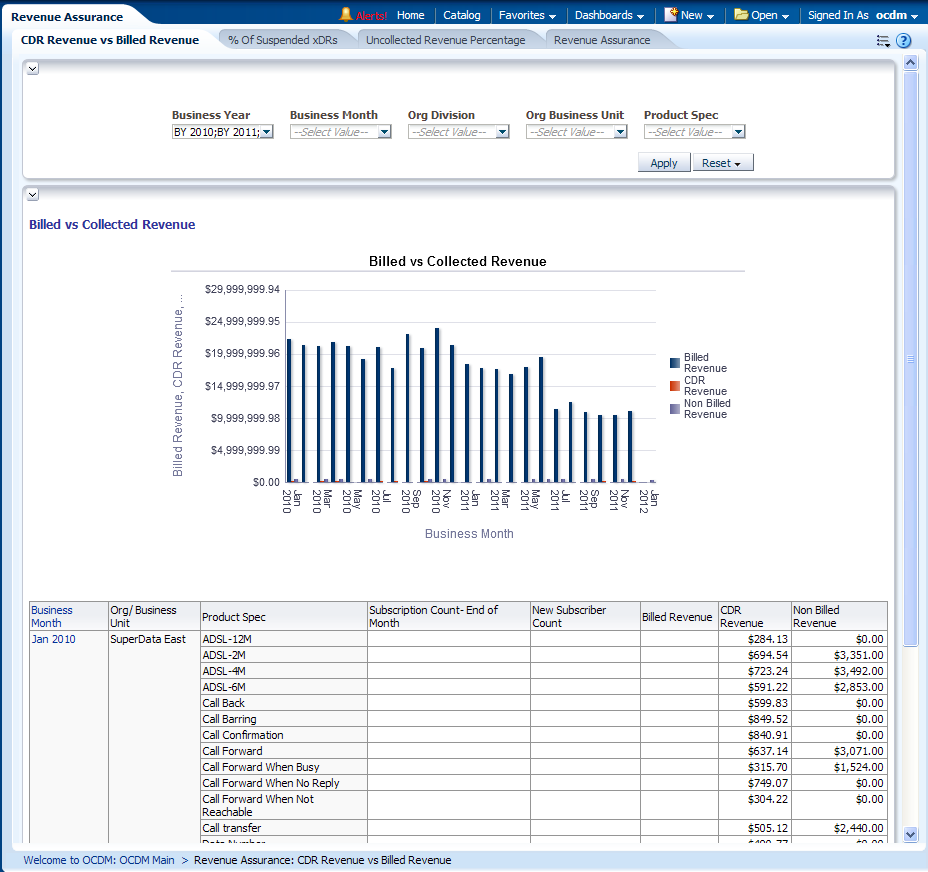

This report, as shown in Figure 12-29 analyzes CDR revenue, and compares, billed revenue with collected revenue for a product specification.

Report dimensions are:

Business Time

Organization

Product Specification

Figure 12-29 CDR Revenue Compared to Billed Revenue Report

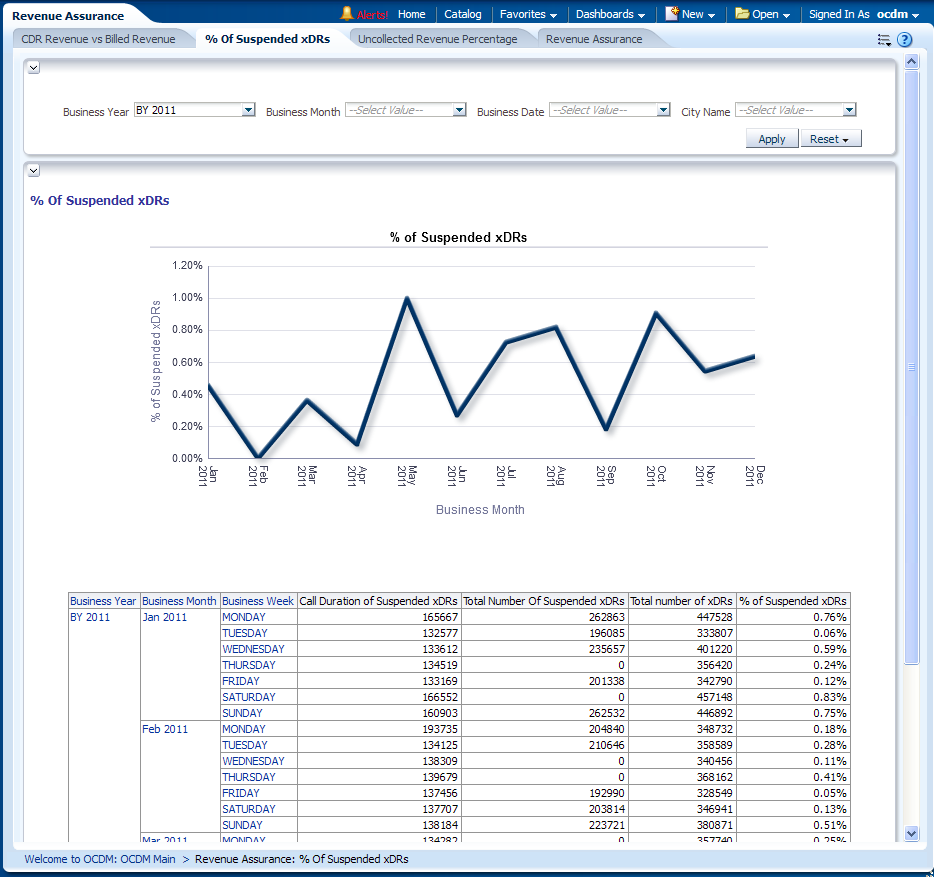

This report, as shown in Figure 12-30 shows analyzes suspended or errored billable xDRs. Those CDRs cannot be billed successfully and cause revenue leakage compared with the total xDRs.

Report dimensions are:

Business Time

Geography

Figure 12-30 Revenue Assurance Percent of Suspended xDRs Report

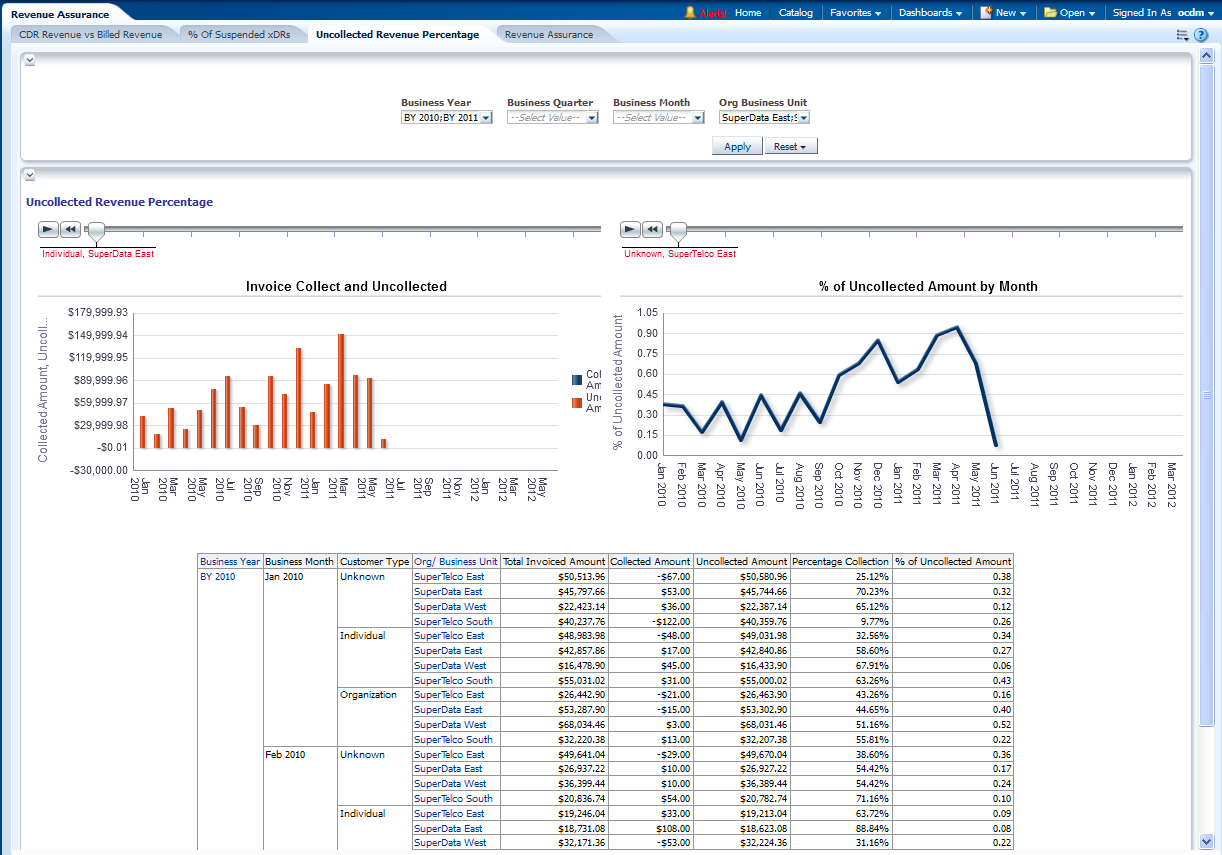

This report, as shown in Figure 12-31 analyzes the collected invoice amount and the uncollected amount for each Month. This is also a way to monitor the revenue leakage.

Report dimensions are:

Business Time

Organization

Customer Type

Geography

Product

Figure 12-31 Revenue Assurance Uncollected Revenue Percentage Report

This report, as shown in Figure 12-32 determines how to best to assure that all of the revenue is earned. This is done by analyzing the revenue related information such as Remaining contract SUM, Retention count, and so on.The remaining contract Sum indicates how much revenue can be expected in next six months or one year for a given product or organization business unit.

Report dimensions are:

Business Time

Organization

Product Offering

Geography

This area includes the reports: Gross Sales and Net Sales.

This report, as shown in Figure 12-33 provides month-level sales summary information, for one or more locations.

Report dimensions are:

Business Time

Product

Geography

This report, as shown in Figure 12-34 provides month-level net sales summary, for one or more locations. The exact definitions of net sales can be refined by the service operator, while the default definition is the sales amount deducted by the cost of handset, human resources, and so on.

Report dimensions are:

Business Time

Product

Geography

This area includes the reports: Debt Aging, Recovered Revenue Value, External Debt Collection, and Adjustment to Customer.

This report, as shown in Figure 12-35 generates debt aging details for the customers currently in debt.

Report dimensions are:

Business Time

Organization

Debt Aging Band

Customer Type

Collection Agency

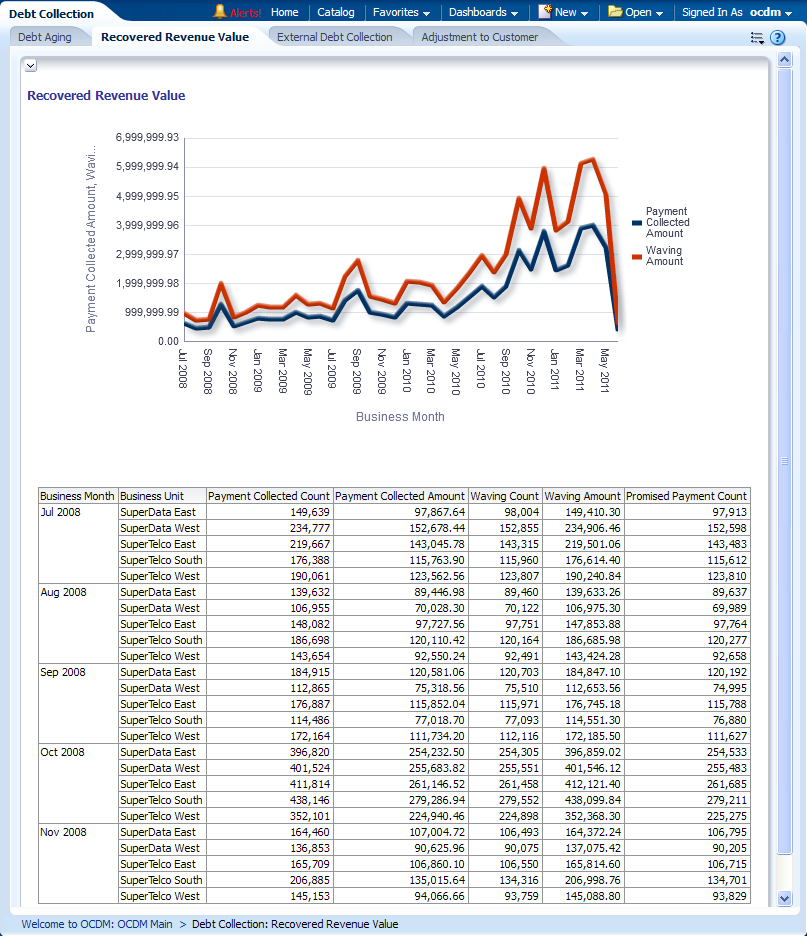

This report, as shown in Figure 12-36 analyzes percentage of the recovered revenue value. After a certain period, if customer still cannot pay the bill, the collection begins. This report can analyze, for all collection amounts, how much is recovered and how much is abandoned.

Report dimensions are:

Business Time

Organization

Collection Agency

Figure 12-36 Revenue Debt Collection Recovered Revenue Value Sample Report

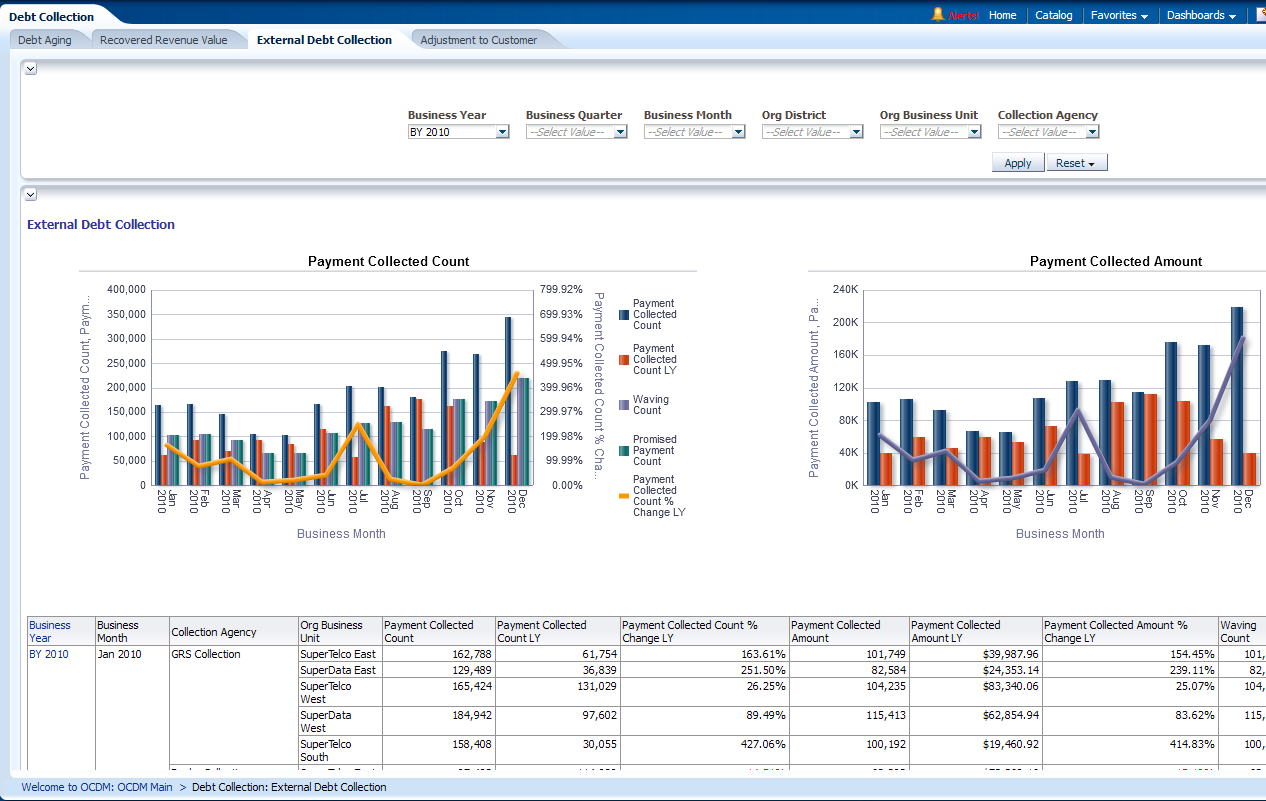

This report, as shown in Figure 12-37 shows collection agency wise debt collected amount waiving amount.

Report dimensions are:

Business Time

Organization

Collection Agency

Figure 12-37 Revenue Debt Collection External Debt Collection Report

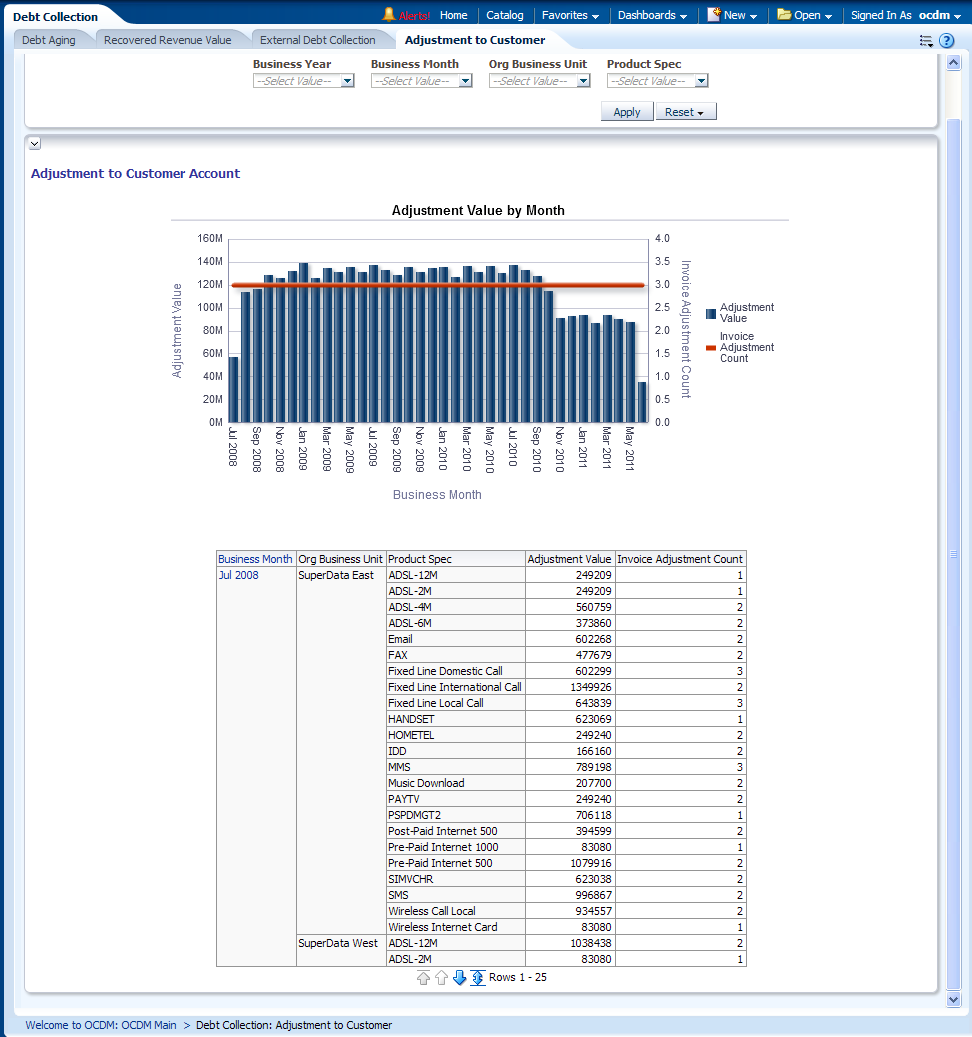

This report, as shown in Figure 12-38 describes the adjustment value and count for each product.

Report dimensions are:

Business Time

Product

Figure 12-38 Revenue Debt Collection Adjustment to Customer Report

This area includes the reports: Refund to Customer and Invoice Adjustment.

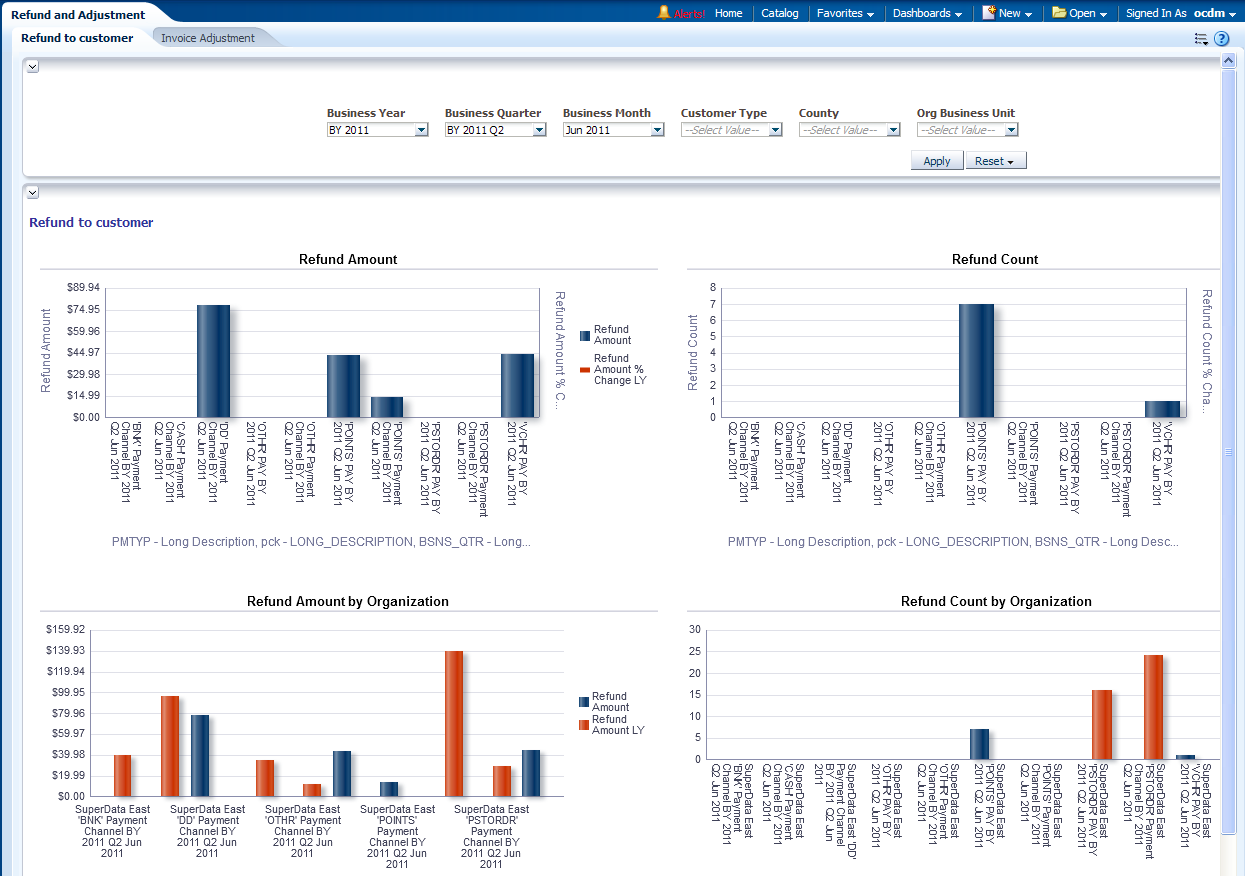

This report, as shown in Figure 12-39 provides summary information about all the refunds made to the customer. for one or more locations.

Report dimensions are:

Business Time

Customer Type

Geography

Organization

Figure 12-39 Revenue Refund and Adjustment Refund to Customer Report

This report, as shown in Figure 12-40 describes adjustment value and count for each product.

Report dimensions are:

Business Time

Product

This area includes the reports: Customer Sum of Future Plans, Monthly Future Plan Drop-Out, and Monthly Contract Sum Loss.

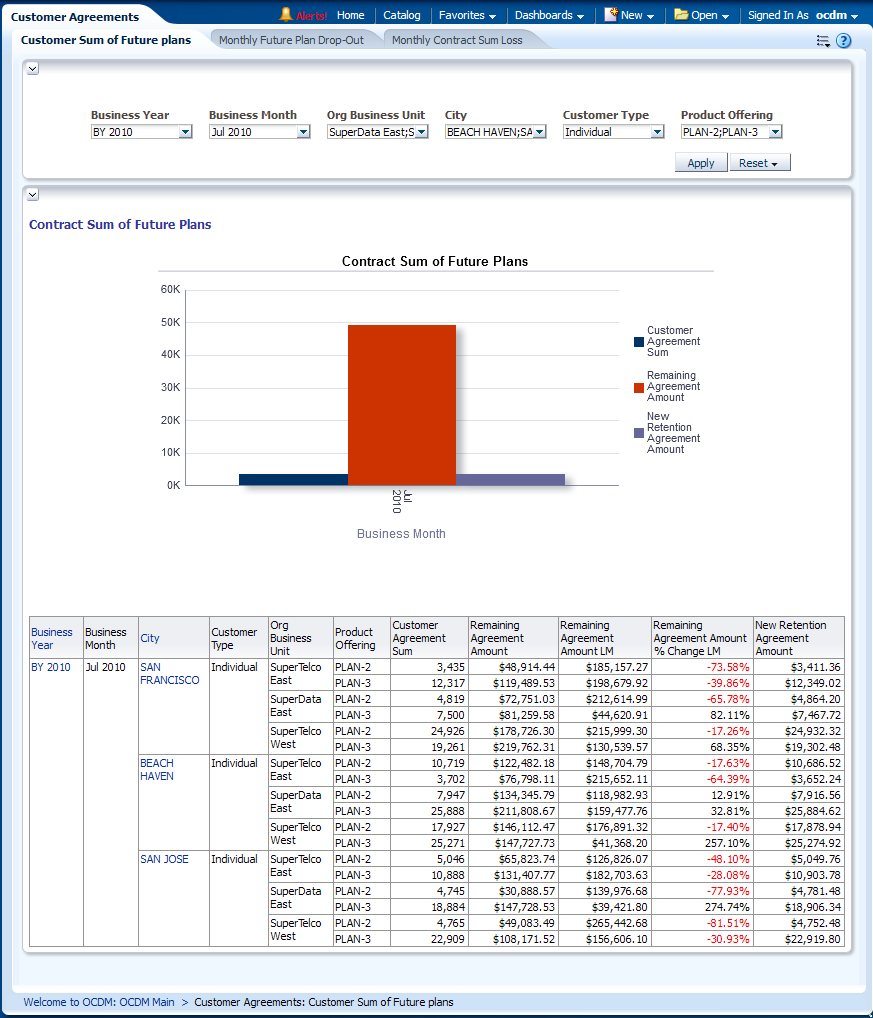

This report, as shown in Figure 12-41 analyzes year and month level contract sum of future plans for the customer type based on LM, % Change LM. The future plan are those contracts customer already signed but not started yet. For example, if today is Feb 20th 2011, and customer may sign a contract starting at Apr 1st 2011 for one year. This is called a Future plan.

Report dimensions are:

Business Time

Organization

Product

Geography

Customer

Figure 12-41 Revenue Customer Agreements Customer Sum of Future Plans Report

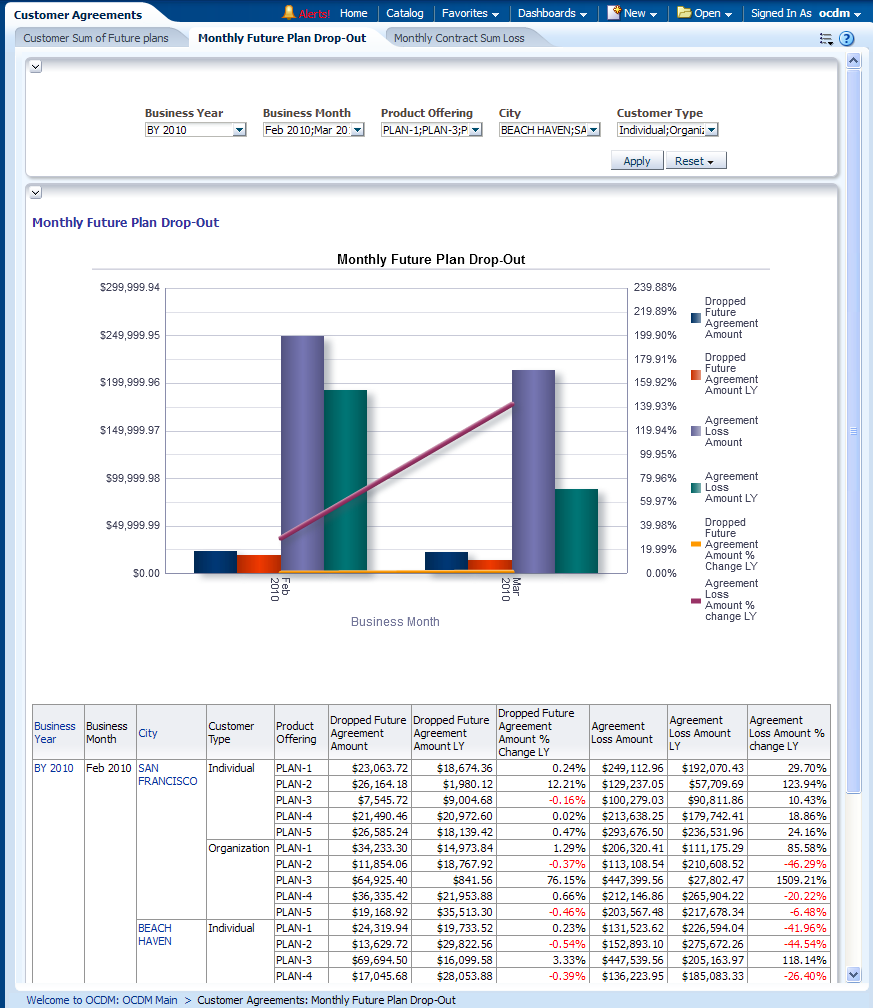

This report, as shown in Figure 12-42 describes product offering wise dropped contract amount and contract loss amount.

Report dimensions are:

Business Time

Customer Type

Product

Customer

Figure 12-42 Revenue Customer Agreements Monthly Future Plan Drop-Out Report

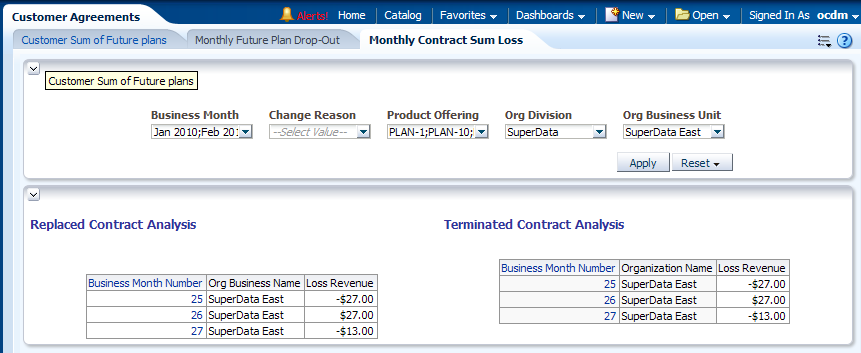

This report, as shown in Figure 12-43 shows month level replaced contract analysis and terminated contract analysis. If a customer downgrades their subscription, for example, using a new USD 186 package to replace original USD286 package, this is deemed as a contract loss in "replaced contract analysis".

Report dimensions are:

Business Time

Organization

Product

Customer

Figure 12-43 Revenue Customer Agreements Monthly Contract Sum Loss Report

The product specification management reports include the following areas:

This area includes the report Product Performance.

This report, as shown in Figure 12-44 provides year-level transaction activity information based on total bill amount measures, for one or more products.

Report dimensions are:

Business Time

Product

This report, as shown in Figure 12-45 shows average profit per customer.

Report dimensions are:

Business Time

Organization

Product

Customer

The provisioning and activation reports show the following areas:

This area includes the report Activation and Service Orders.

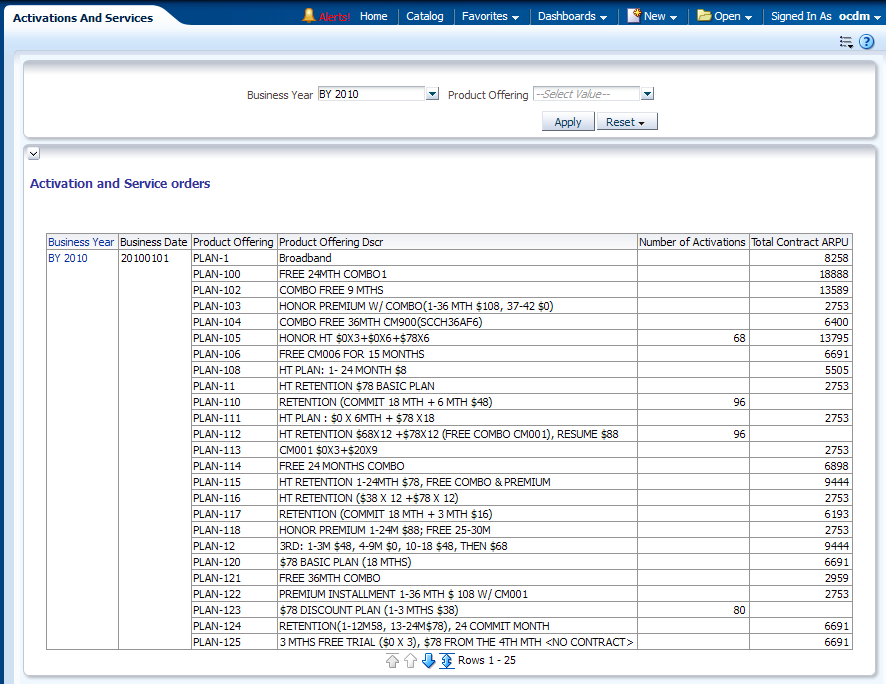

This report, as shown in Figure 12-46 provides business year and business date-level transaction activity information based on contract ARPU.

Report dimensions are:

Business Time

Product Specification

Figure 12-46 Activation and Service Orders Report

This area includes the report: Order Volume by Order Status, Order Volume by Order Type, Order Volume by Product Specification, Order Change per Quarter, Order Volume by Product Specification Type, and Fall Out Rate by Product Specification Type.

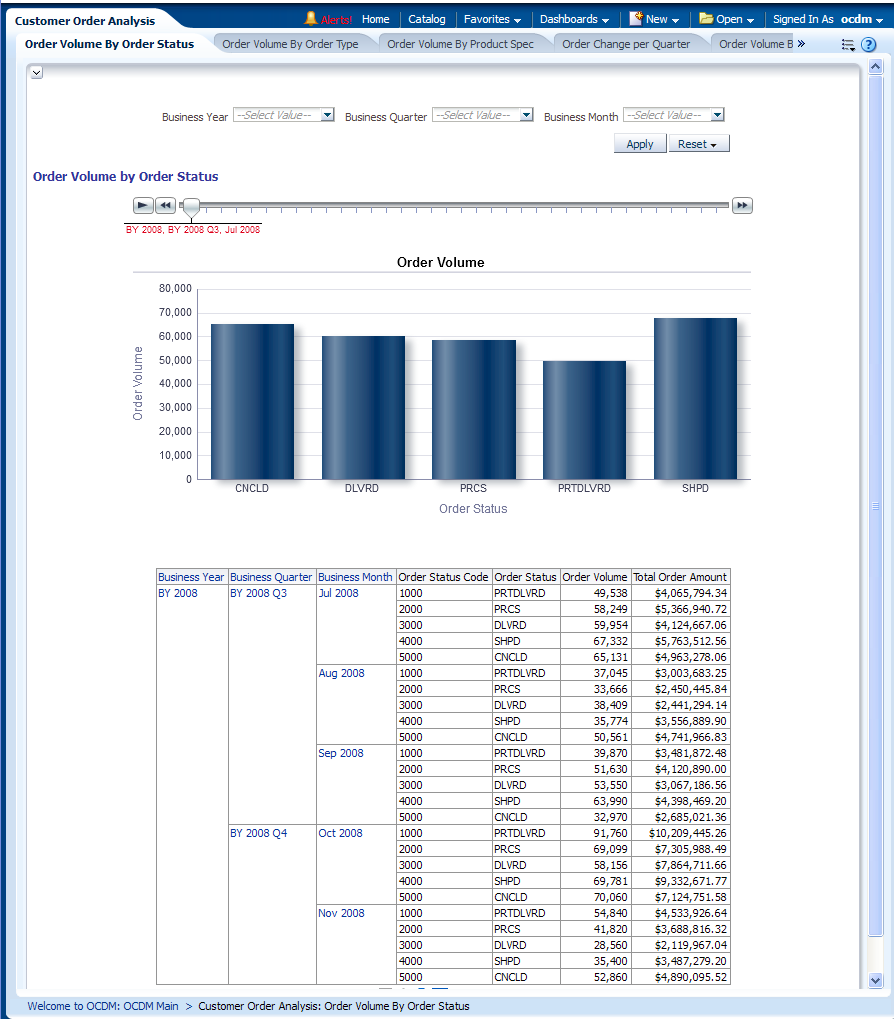

This as shown in Figure 12-47, provides business year, business quarter, and business month-level information based on order volume by order status.

Report dimensions are:

Business Time

Figure 12-47 Customer Order Analysis Order Volume by Order Status

This report, as shown in Figure 12-48 provides business year, business quarter, and business month-level information based on order volume by order type.

Report dimensions are:

Business Time

Figure 12-48 Customer Order Analysis Order Volume by Order Type Report

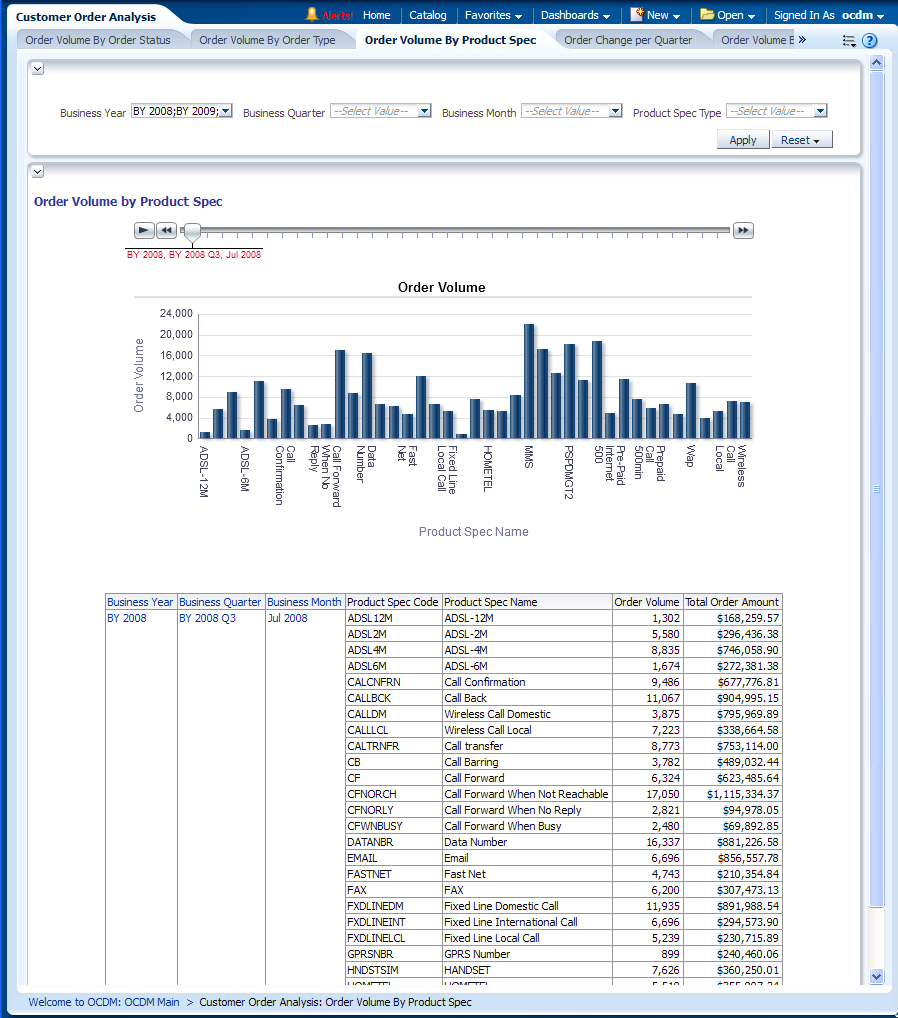

This report, as shown in Figure 12-49 business year, business quarter, and business month-level information based on order volume by product.

Report dimensions are:

Business Time

Product Specification

Figure 12-49 Customer Order Analysis Order Volume by Product Specification Report

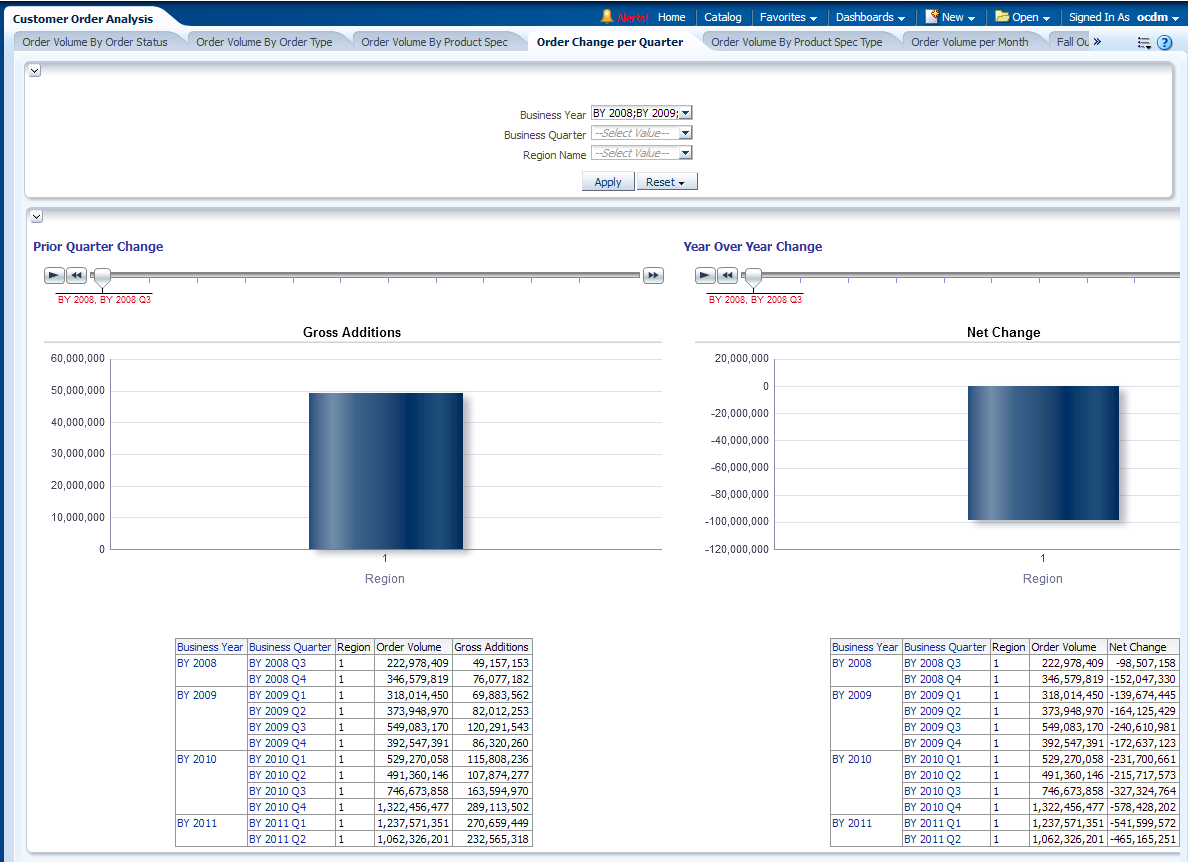

This report, as shown in Figure 12-50 provides business year, business quarter-level information based on order volume change per quarter.

Report dimensions are:

Business Time

Product Specification Type

Figure 12-50 Customer Order Analysis Prior Quarter Change Report

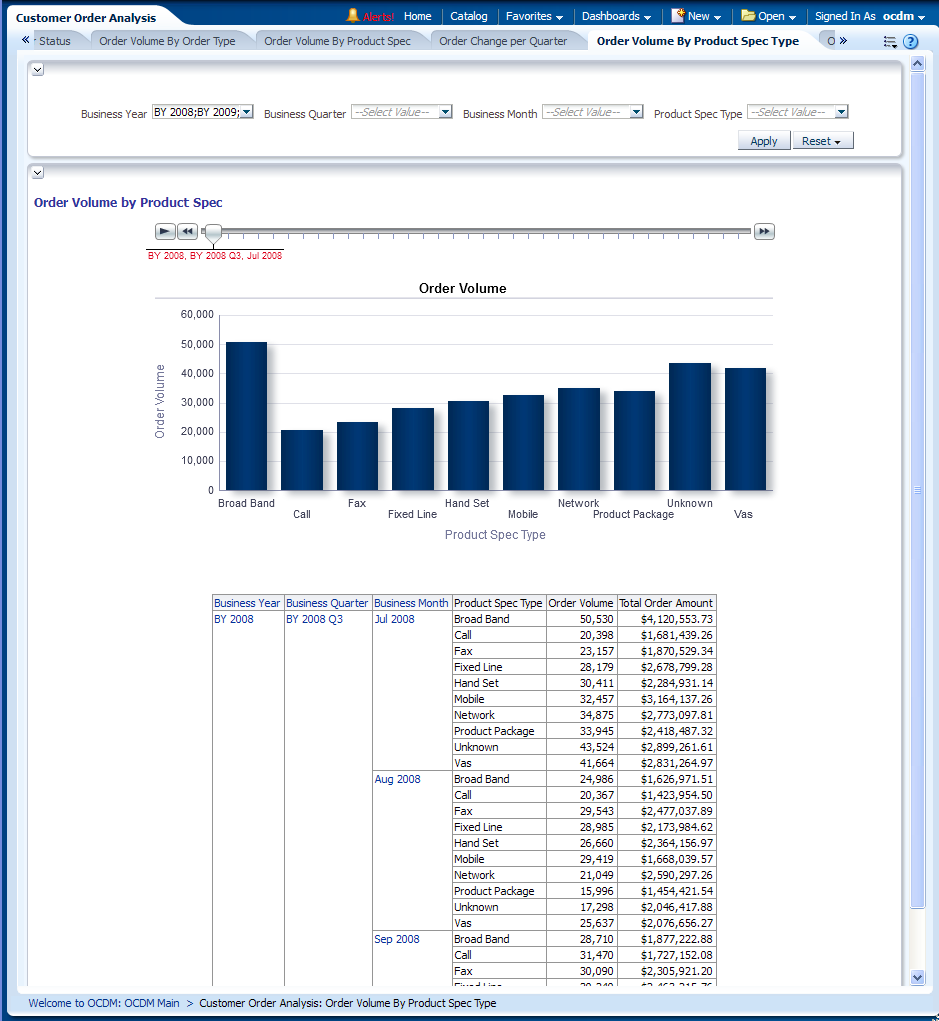

This report, as shown in Figure 12-51 provides business year, business quarter, and business month-level information based on order volume by product type.

Report dimensions are:

Business Time

Figure 12-51 Customer Order Analysis Order Volume by Product Specification Type Report

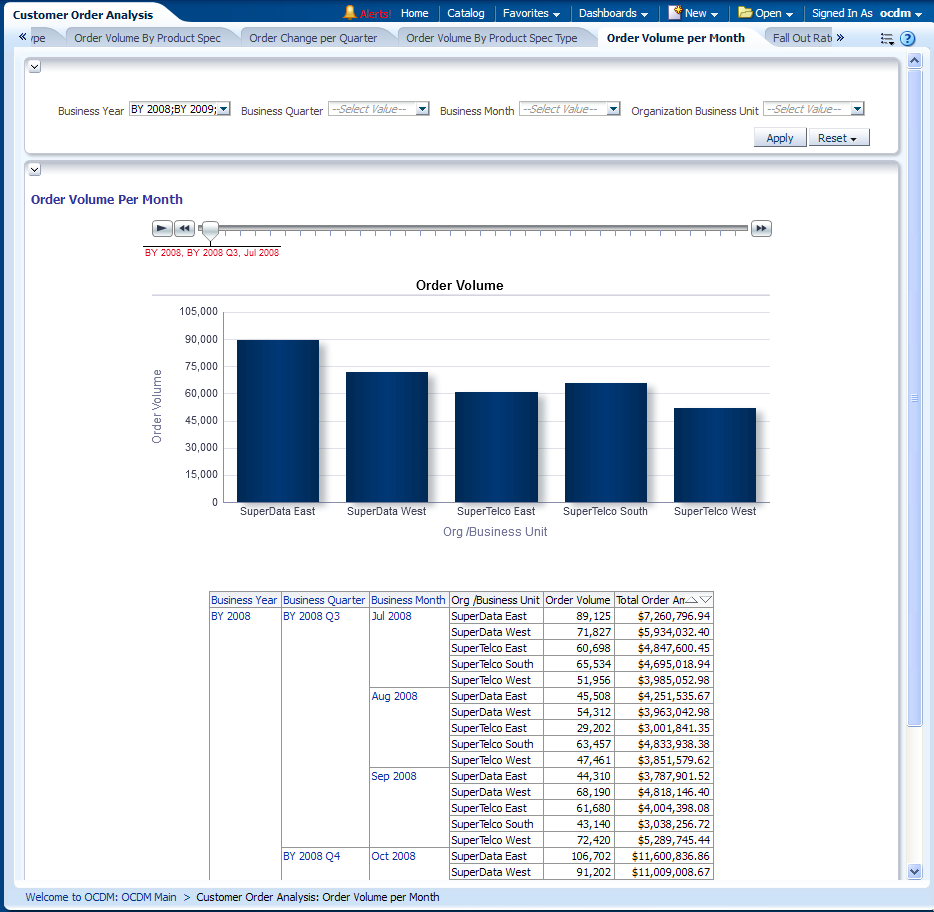

This report, as shown in Figure 12-52 provides business year, business quarter, and business month-level information based on order volume per month.

Report dimensions are:

Business Time

Organization Unit

Figure 12-52 Customer Order Analysis Order Volume per Month Report

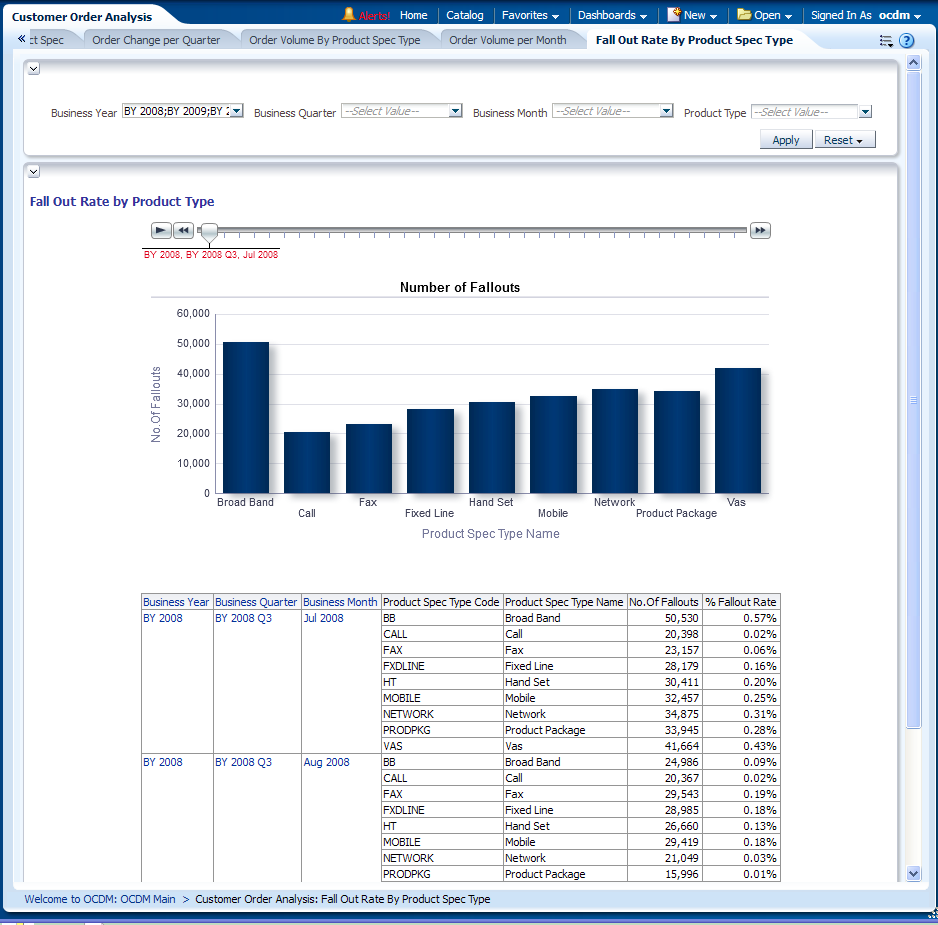

This report, as shown in Figure 12-53 provides business year, business quarter, and business month-level information based on fall out rate by product specification type.

Report dimensions are:

Business Time

Figure 12-53 Customer Order Analysis Fall Out Rate by Product Specification Type Report

The network area reports include the following areas:

This area includes the reports: Network Capacity, Minutes of Usage, Airtime per Subscription, and Load During Busy Hours.

This report, as shown in Figure 12-54 provides month-level transaction activity information based on network capacity measures, for one or more locations.

Report dimensions are:

Business Time

Geography

Network Element

This as shown in Figure 12-55 provides month-level call usage summary information based on call duration in minutes, in certain areas and the network elements.

Report dimensions are:

Business Time

Network Element

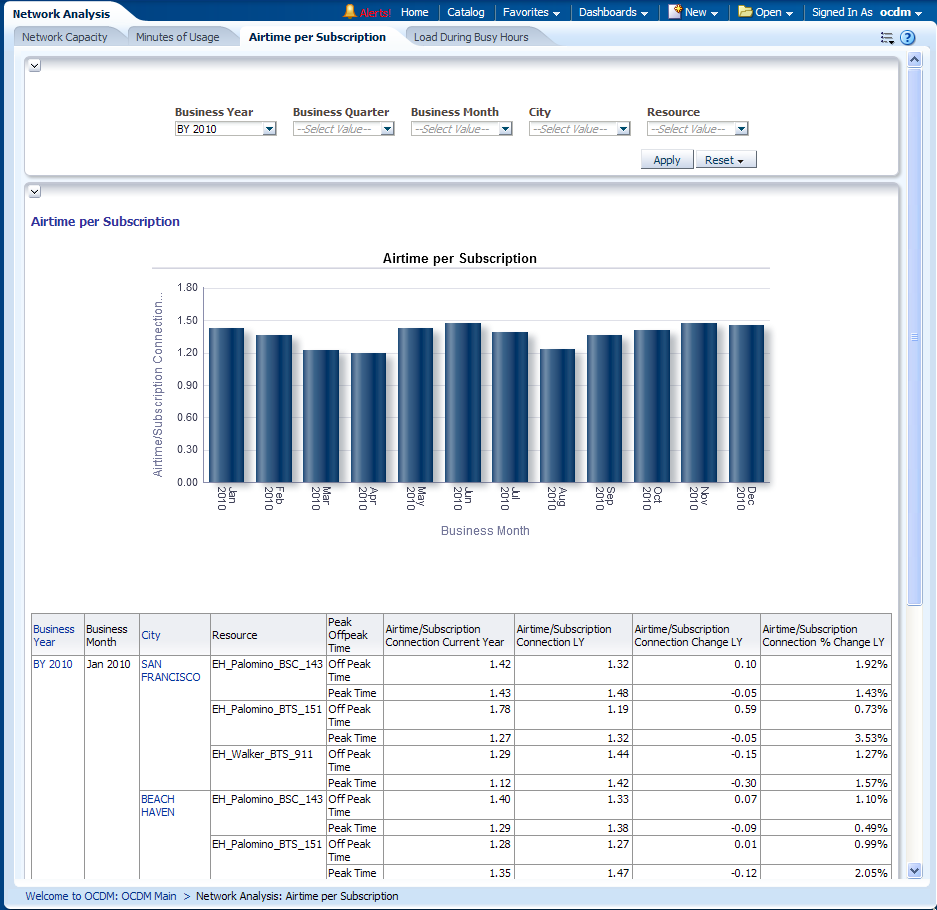

This as shown in Figure 12-56 provides month-level transaction activity information based on airtime per subscription connection measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

Peak Off peak Time

Figure 12-56 Airtime per Subscription Report

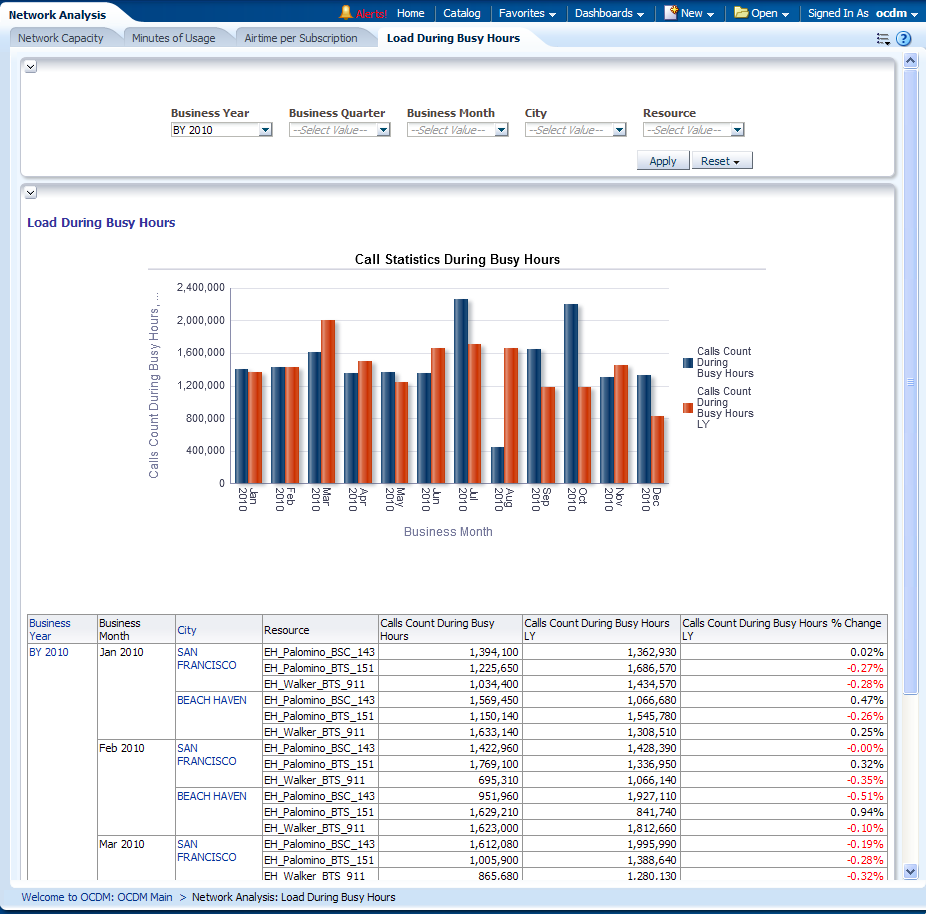

This report, as shown in Figure 12-57 provides month-level transaction activity information based on calls count during busy hours measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

Peak Off peak Time

Figure 12-57 Load During Busy Hours Report

This area includes the reports: Traffic by Connection, Connections per Site, Dropped Call Rate, Call Failure Rate, Congestion, Connection by Geography, and Connection by Voice Channel.

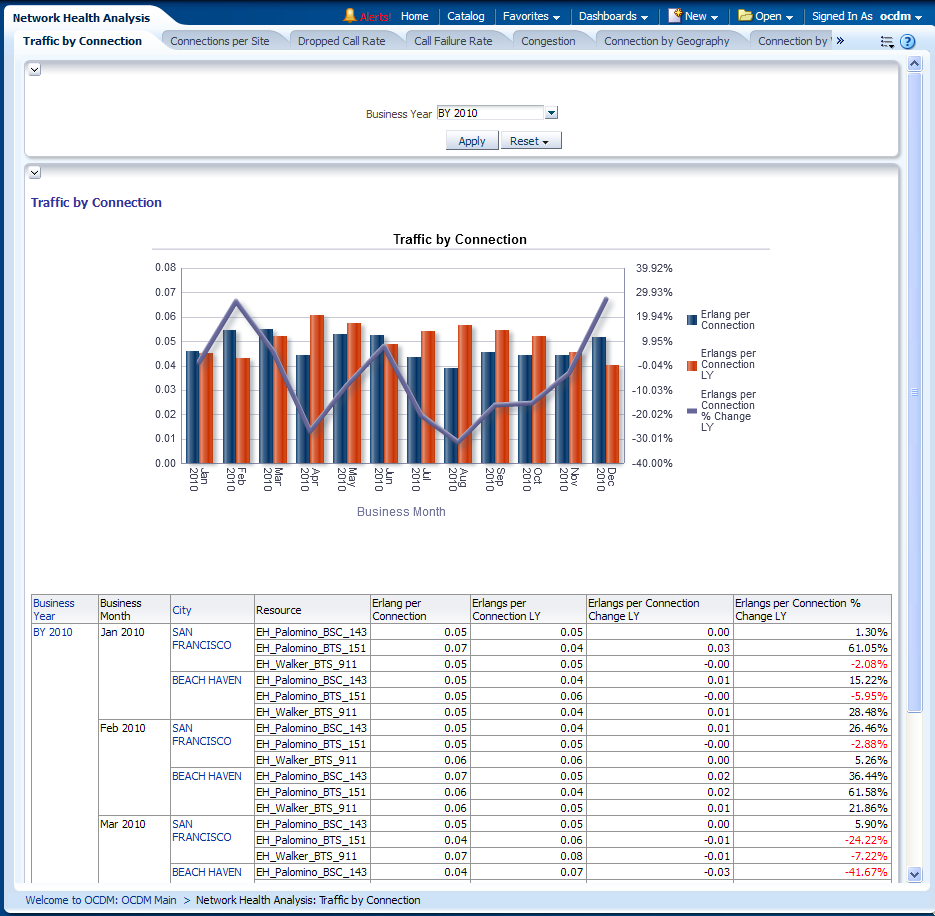

This report, as shown in Figure 12-58 provides month-level transaction activity information based on traffic by connection measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

Peak Off peak Time

Figure 12-58 Traffic by Connection Report

This report, as shown in Figure 12-59 provides month-level transaction activity information based on subscriptions per channel measures, for one or more location.

Report dimensions are:

Business Time

Resource

Geography

This report, as shown in Figure 12-60 provides month-level transaction activity information based on dropped call rate measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

This report, as shown in Figure 12-61 provides month-level transaction activity information based on network congestion measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

This report, as shown in Figure 12-62 provides month-level transaction activity information based on end of period cell offered erlangs measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

Time Slot

Peak Offpeak Time

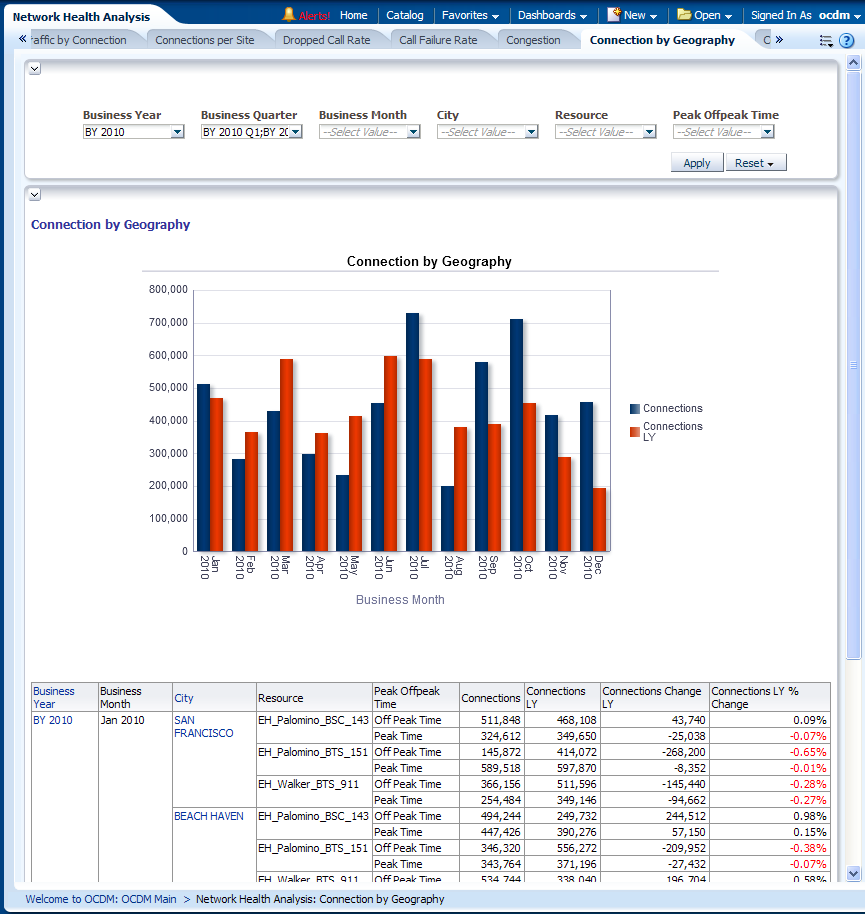

This report, as shown in Figure 12-63 provides month-level transaction activity information based on connections measures, for one or more location.

Report dimensions are:

Business Time

Network Element

Geography

Peak Offpeak Time

Figure 12-63 Connection by Geography Report

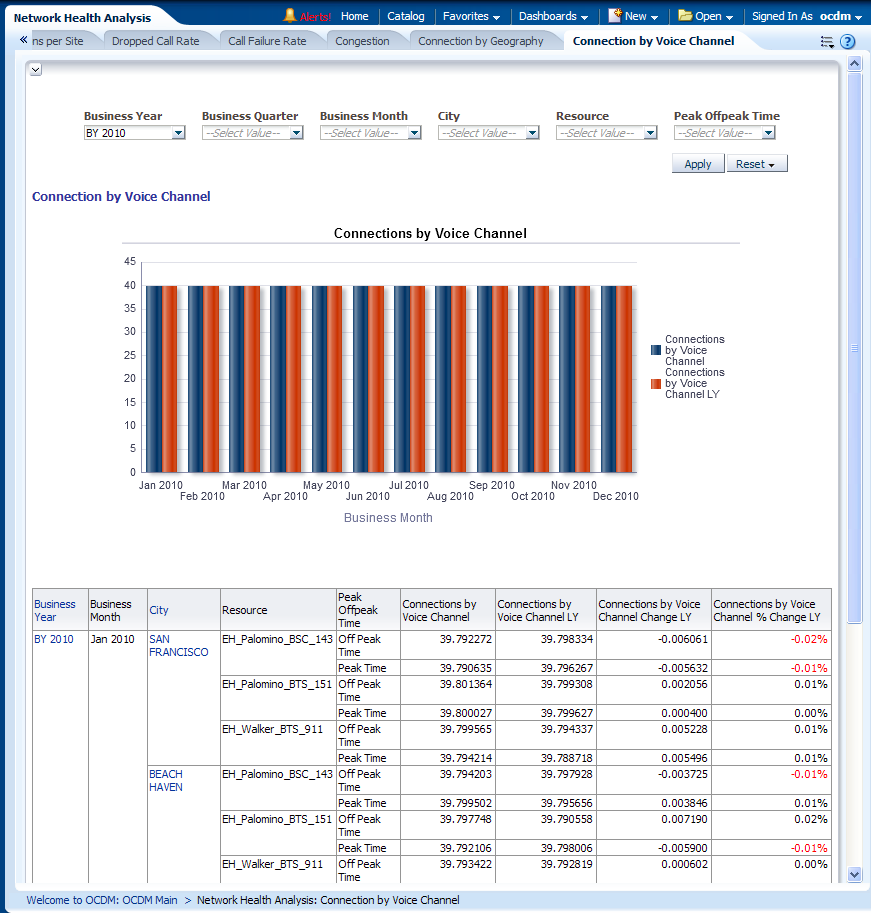

This report, as shown in Figure 12-64 provides month-level transaction activity information based on connections by voice channel measures, for one or more location. This report shows will be used to collect most of the cell parameters.

Report dimensions are:

Business Time

Network Element

Geography

Peak Offpeak Time

Figure 12-64 Connection by Voice Channel Report

This area includes the reports: Number of Emergency Calls, Number of Call by Call Service Type, Number of Calls by Roaming Type, and Minutes of Usage by Call Type.

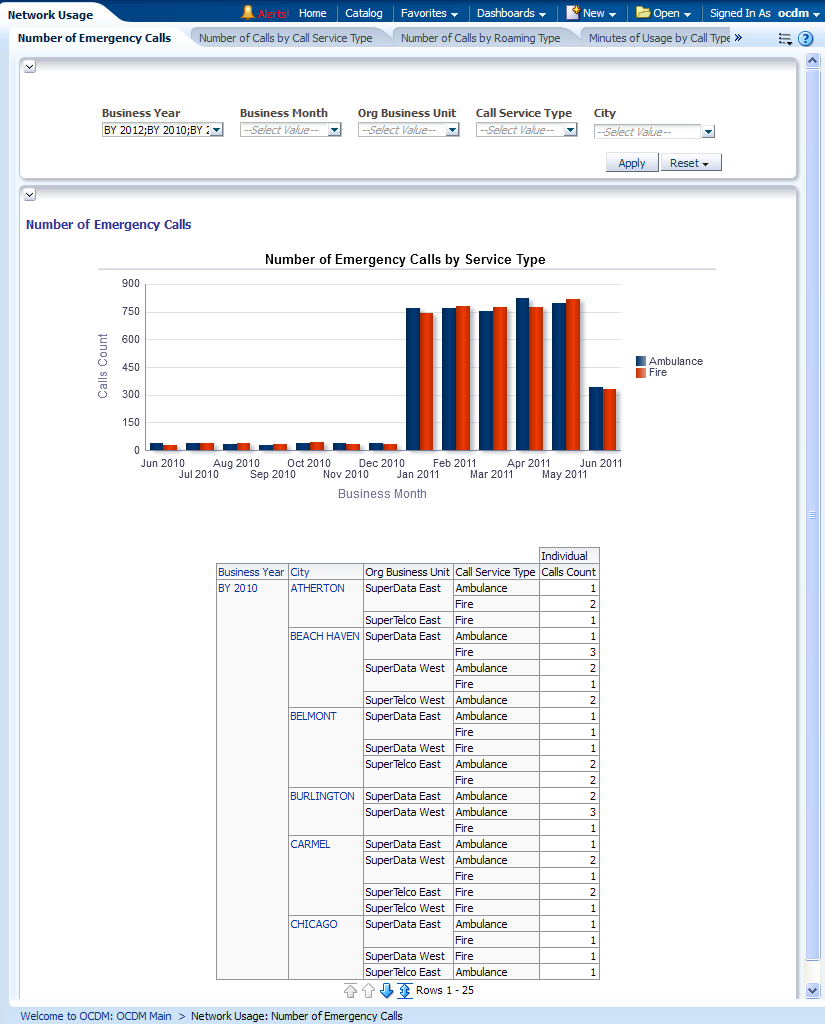

This report, as shown in Figure 12-65 provides the number of emergency calls.

Report dimensions are:

Organization

Business Time

Customer

Product

Call Service Type

Call Routing Type

Figure 12-65 Network Number of Emergency Calls Report

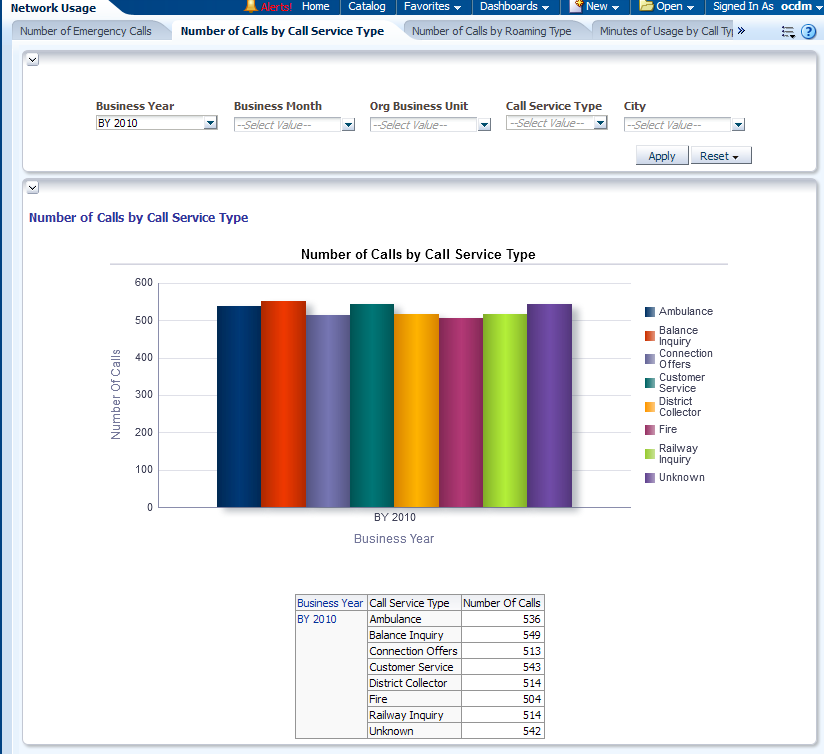

This shown in Figure 12-66 provides year-level transaction activity information based on number of calls measures, for different types of call services.

Report dimensions are:

Business Time

Call Category

Figure 12-66 Network Number of Call by Call Service Type Report

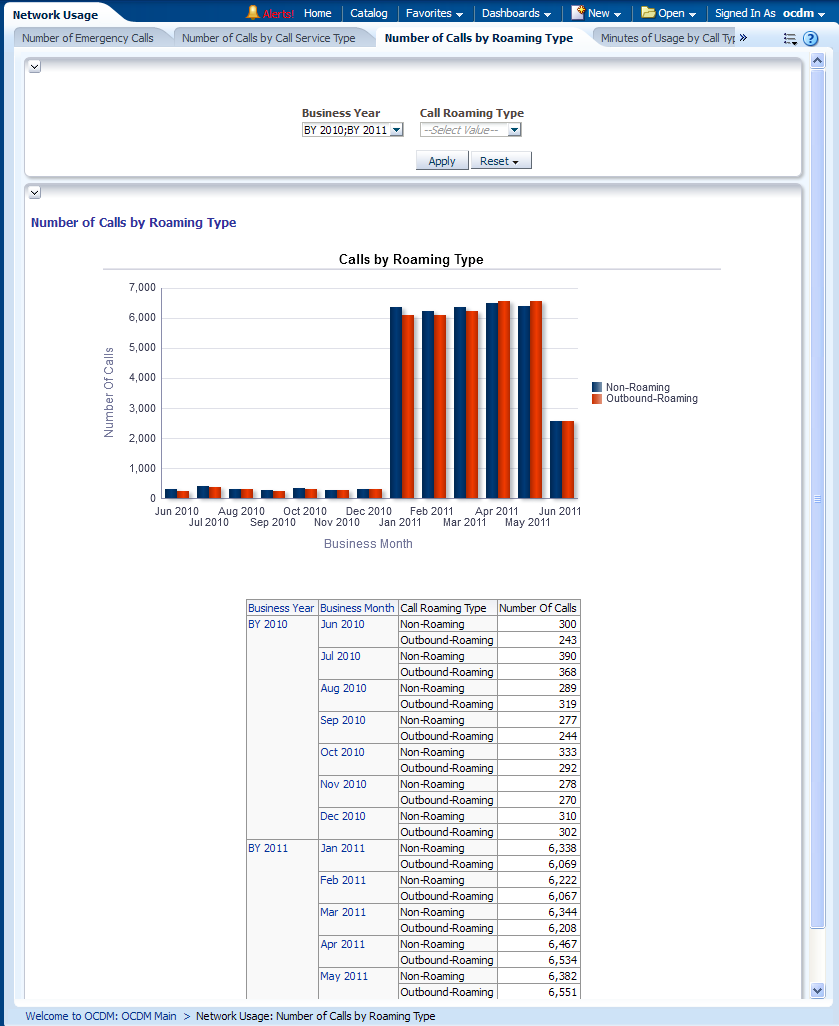

This shown in Figure 12-67 provides year-level transaction activity information based on the number of calls measures, for different types of call roaming.

Report dimensions are:

Business Time

Call Routing Type

Figure 12-67 Network Number of Calls by Roaming Type Report

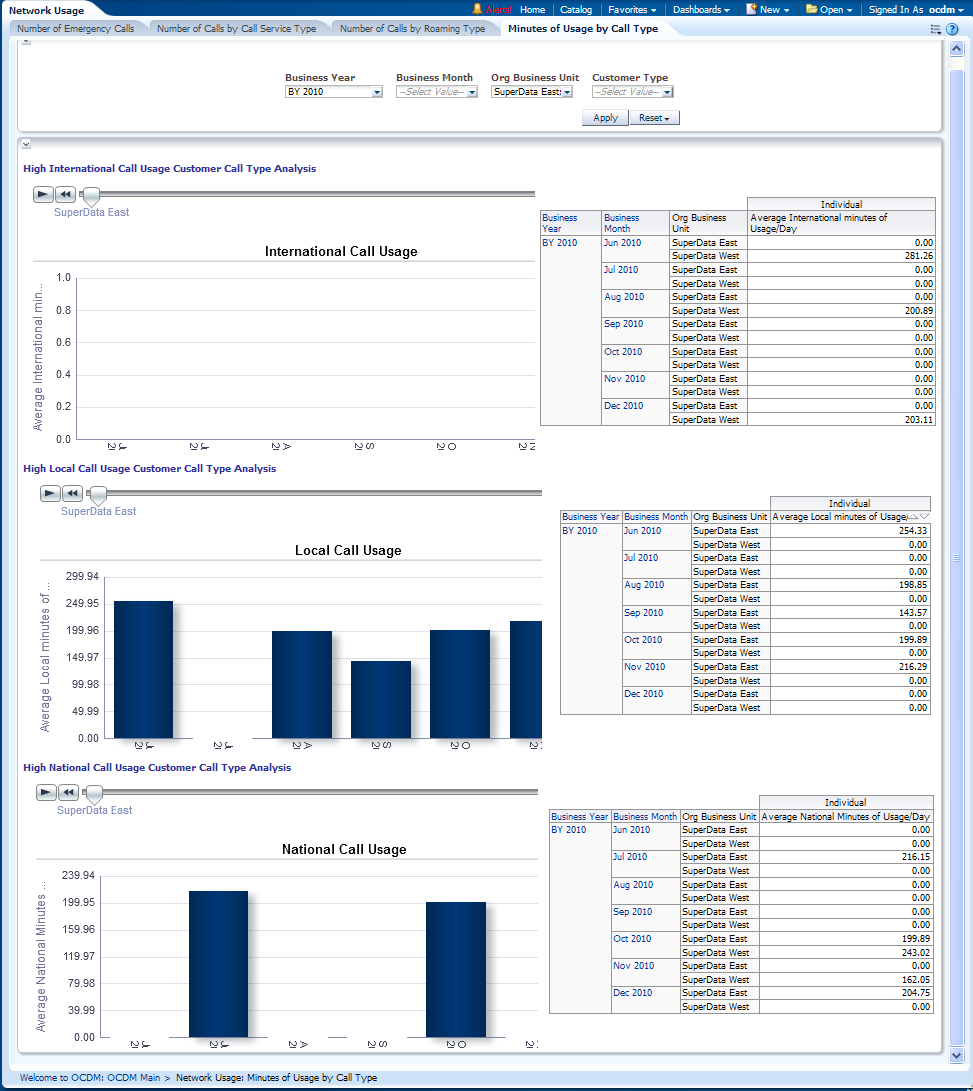

This as shown in Figure 12-68 provides year-level transaction activity information based on no of calls measures, for different types of call categories.

Report dimensions are:

Business Time

Call Category

Figure 12-68 Minutes of Usage by Call Type Report

The marketing area reports include the following areas:

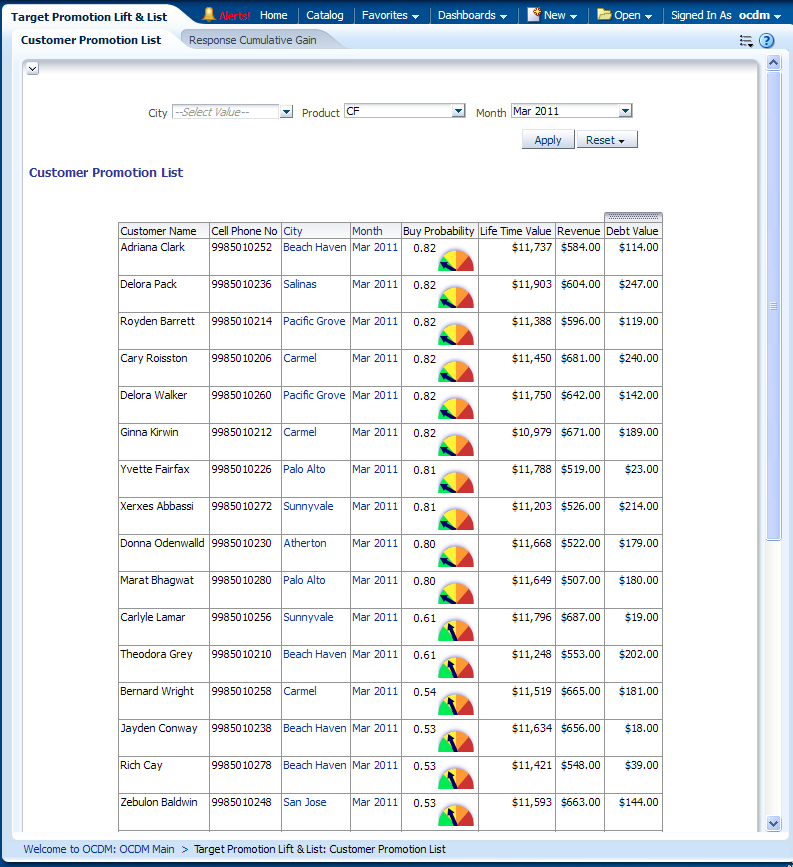

This area includes the report Customer Promotion List and

This report, as shown in Figure 12-69 provides a list of customers ranked by their probability of buying a product. For each customer, the life time value , ARPU, and Debt value are displayed for quick reference.

The buying probability of each customer on the product is calculated by Oracle Communications Data Model Targeted Promotion Mining model.

Report dimensions are:

Customer

Figure 12-69 Customer Promotion List Report

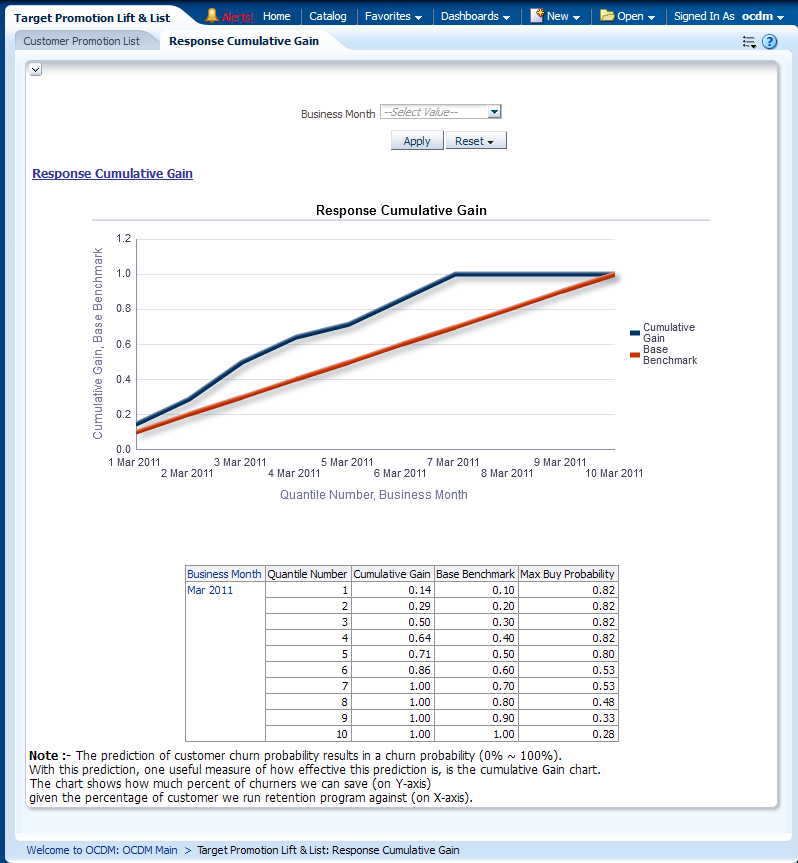

This report as shown in Figure 12-70 shows the Oracle Communications Data Model Churn prediction Model performance; this helps you determine a threshold for the percent of customers to run in the retention program. This retention can be done using phone calls or email. For example, according to the details in Figure 12-70, if the service provider selects 20% of MOST Likely churners according to the Oracle Communications Data Model Churn Prediction model, they can cover about 74% of real churners.

The chart here shows the accuracy of customers so identified under retention program prediction rather than picking on random selection of customers (shown as a straight line).

Report dimensions are:

Churn SVM ROC

Figure 12-70 Response Cumulative Gain Report

This area includes the report Customer Market Share Report.

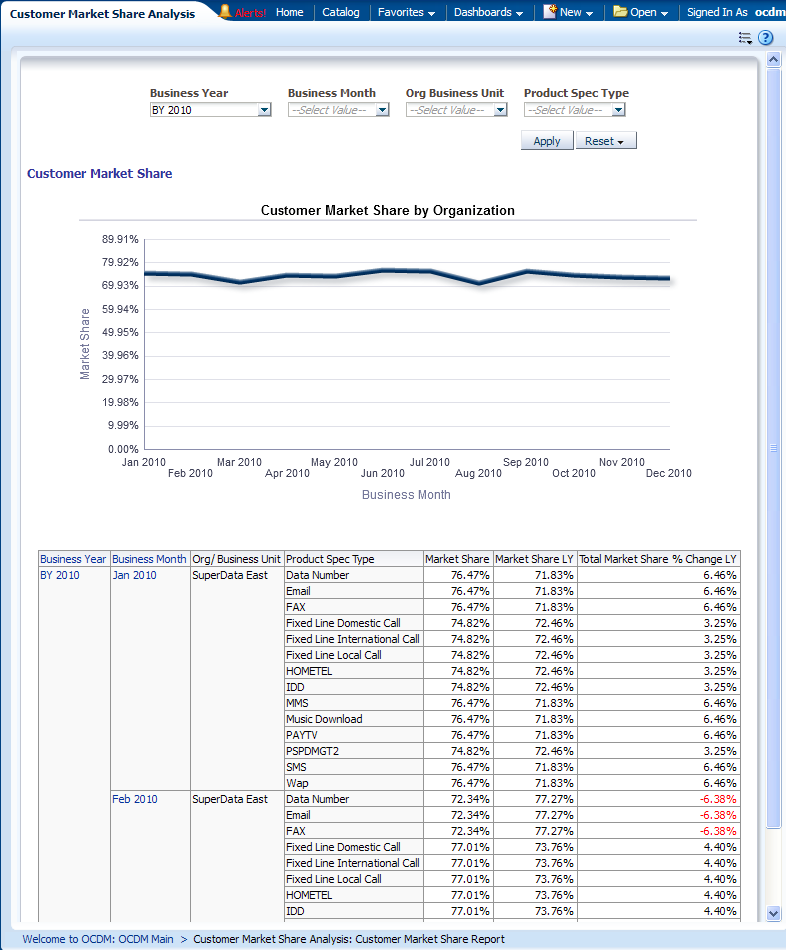

This report as shown in Figure 12-71 shows month-level Customer Market share, comparing with competitors. The data is acquired from an external marketing source.

Report dimensions are:

Business Time

Organization

Product Specification Type

Figure 12-71 Customer Market Share Analysis Report

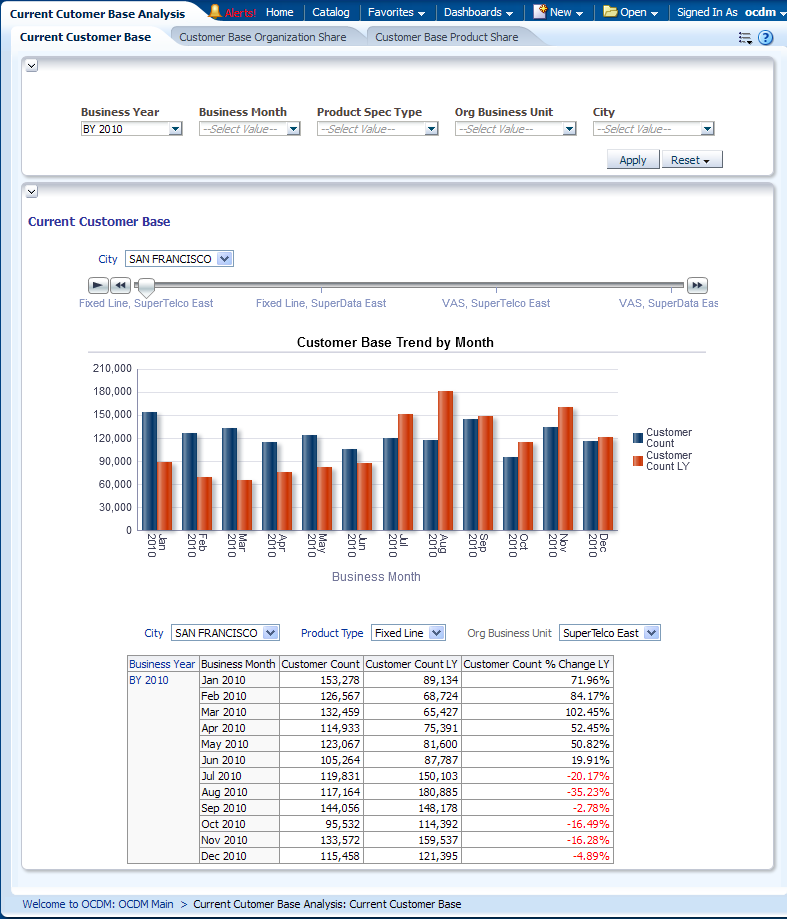

This area includes the reports: Current Customer Base, Customer Base Organization Share, and Customer Base Product Share.

This report, as shown in Figure 12-72 provides month-level transaction activity information based on no of customer measures, for one or more locations.

Report dimensions are:

Business Time

Organization

Product

Geography

Figure 12-72 Current Customer Base Report

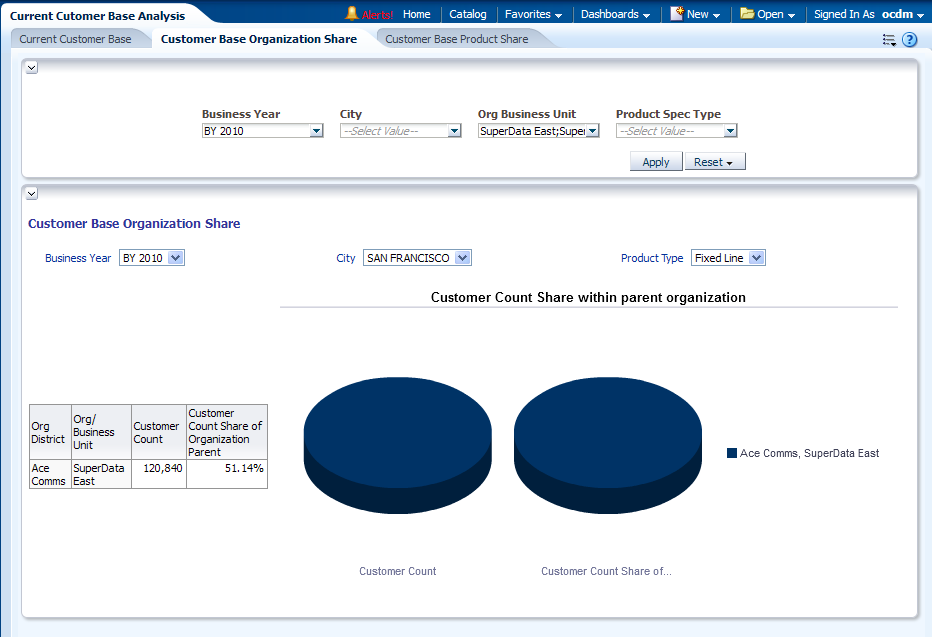

This as shown in Figure 12-73 provides month-level number of customers for each organization business unit, and also gives the share of customer count inside their parent organization.

Report dimensions are:

Business Time

Organization

Product Type

Figure 12-73 Customer Base Organization Share Report

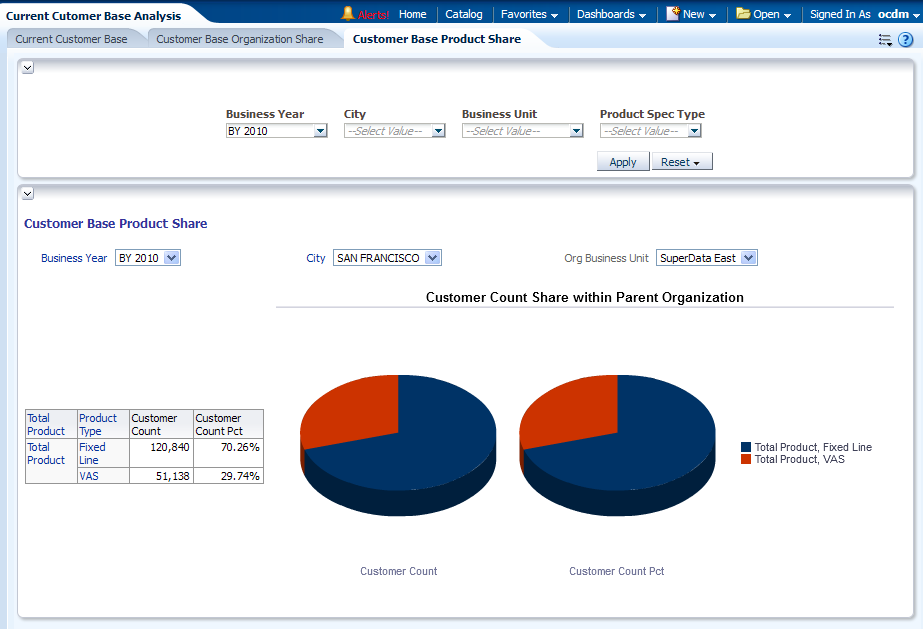

This as shown in Figure 12-74 provides month-level number of customers for each products (subscription). The customer share of each product is listed for the selected products and organizations.

Report dimensions are:

Business Time

Organization

Product Type

Figure 12-74 Customer Base Product Share Report

The cost and contribution reports include the following areas: Operational Finance Analysis and Profitability Analysis.

This area includes the following:

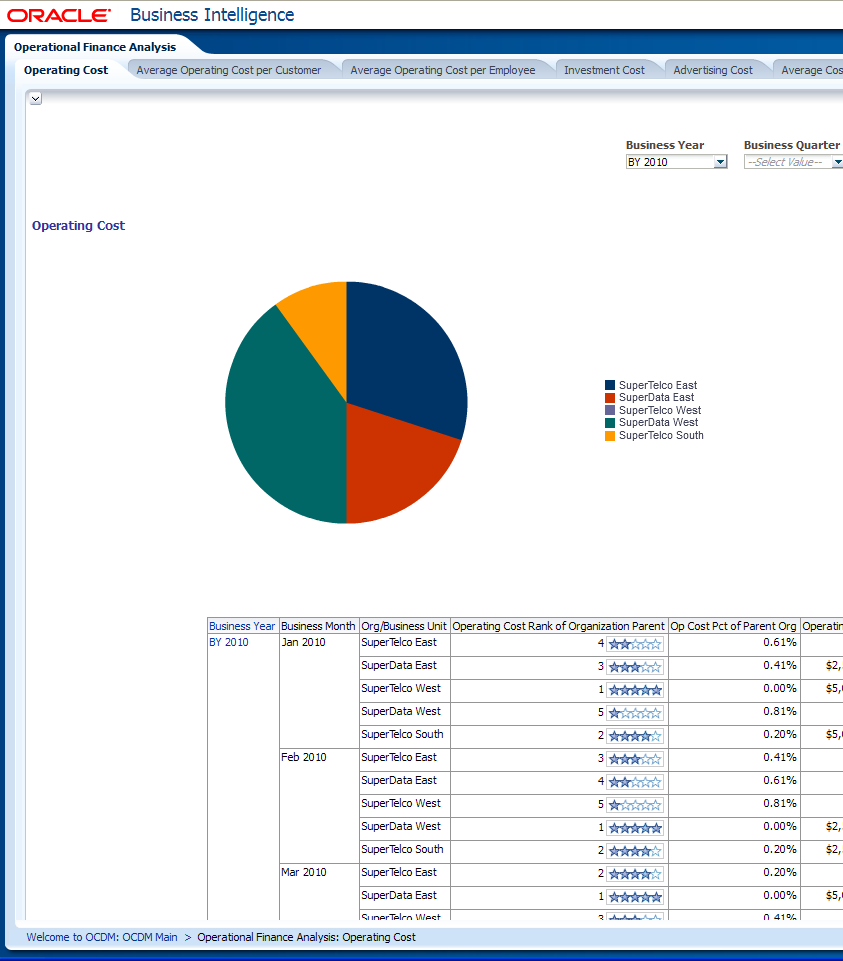

This area includes the reports: Operating Cost, Average Operating Cost per Customer, Average operating Cost per Employee, Investment Cost, Advertising Cost Report, and Average Cost of Controlling Attrition per Employee.

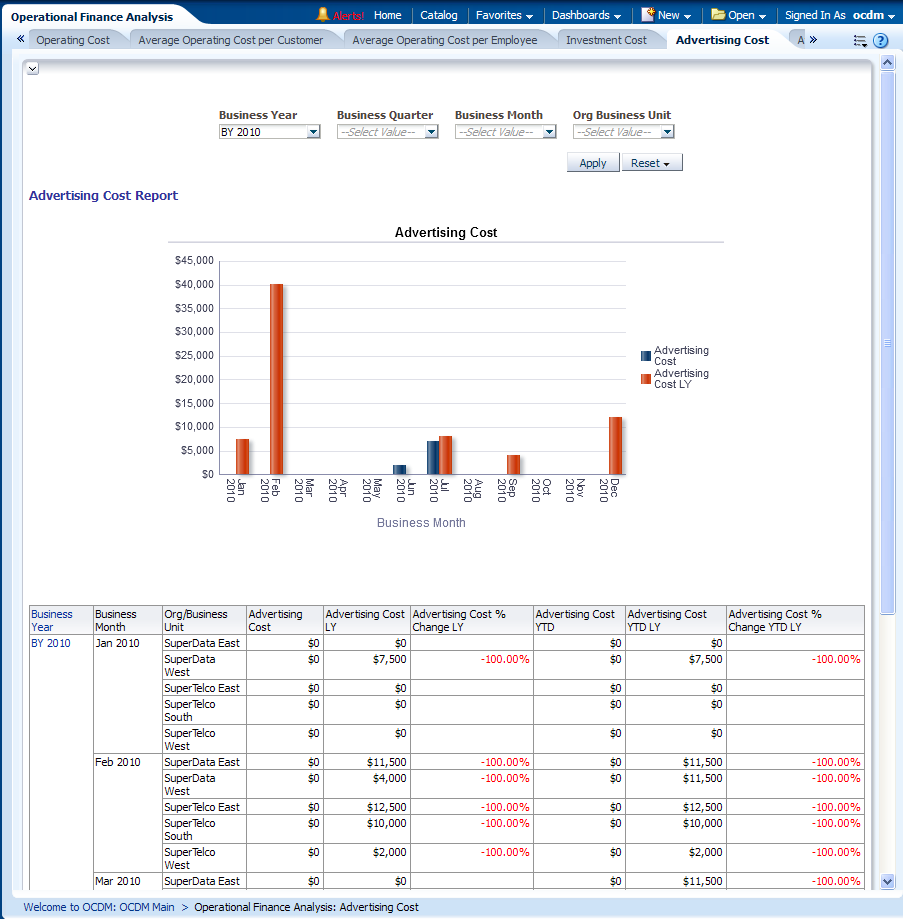

This report, as shown in Figure 12-75 and Figure 12-76 provide the current year month-level "Operating Cost" information for each organization business unit. The report also ranks all organization business units according to their cost in their parent "Organization". The end user can compare the cost with last years metrics such as: LY, % Change LY, YTD, YTD LY, YTD % Change LY.

Report dimensions are:

Business Time

Organization

Figure 12-75 Operating Cost Report (left side of report)

Figure 12-76 Operating Cost Report (right side of report)

This report, as shown in Figure 12-77 provides the current year month-level "Average Operating Cost per Customer" information based on "Organization Unit" which can be compared with last years metrics like LY, % Change LY.

Report dimensions are:

Business Time

Organization

Figure 12-77 Average Operating Cost per Customer Report

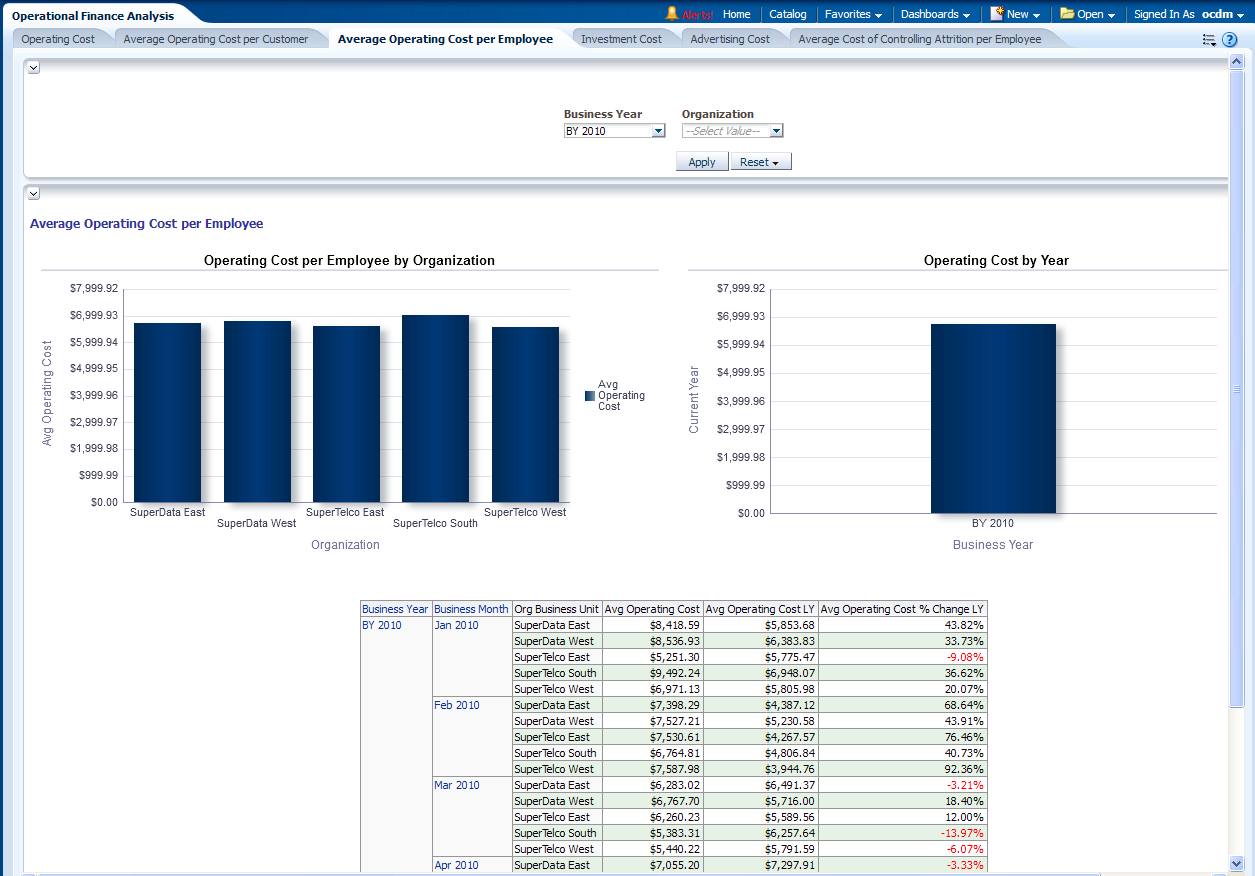

This report, as shown in Figure 12-78 provides the current year "Average Operating Cost per Employee" information based on "Organization Business Unit" which can be compared with last years metrics such as: LY, % Change LY.

Report dimensions are:

Business Time

Organization

Figure 12-78 Cost: Average Operating Cost per Employee

This report, as shown in Figure 12-79 provides the current year month-level "Investment Cost" and "Investment Cost share of parent Organization" information based on "Organization Unit and district" which can be compared with last years metrics like LY, % Change LY, YTD, YTD LY and YTD % Change LY.

Report dimensions are:

Business Time

Organization

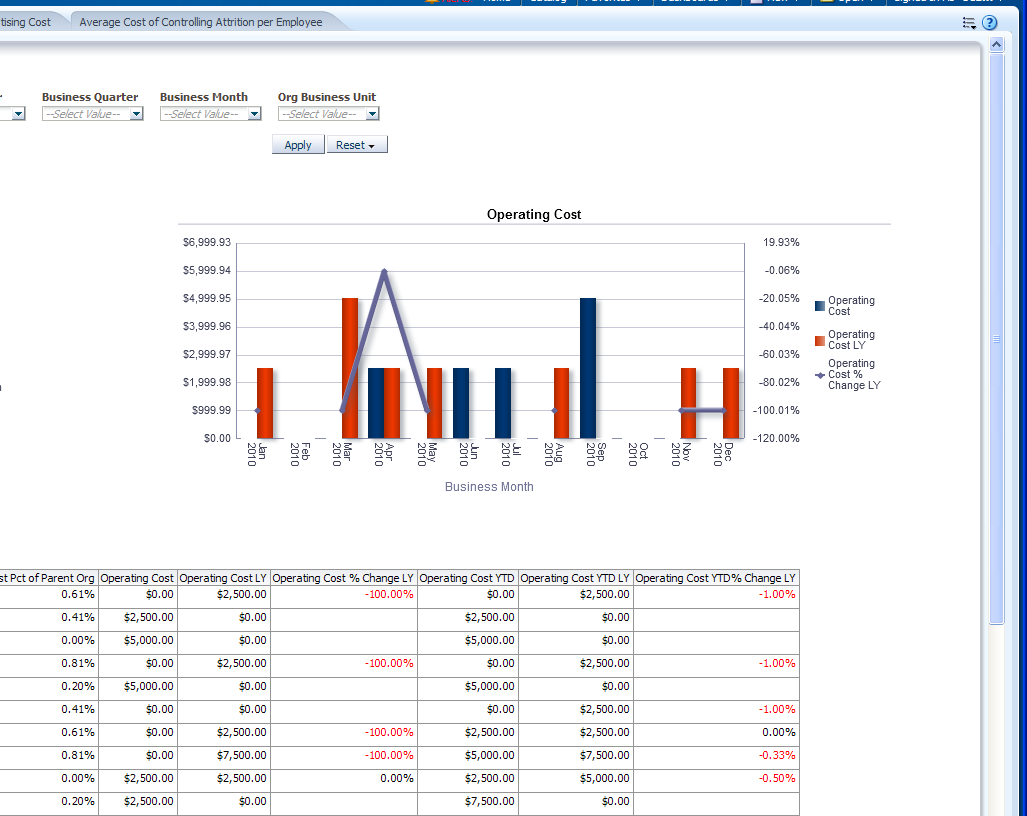

This report, as shown in Figure 12-80 provides the current year month-level "Advertising Cost" information based on "Organization Parent" which internally can be compared with last years metrics like LY,% Change LY, YTD, YTD LY, YTD % Change LY.

Report dimensions are:

Business Time

Organization

Figure 12-80 Advertising Cost Report Report

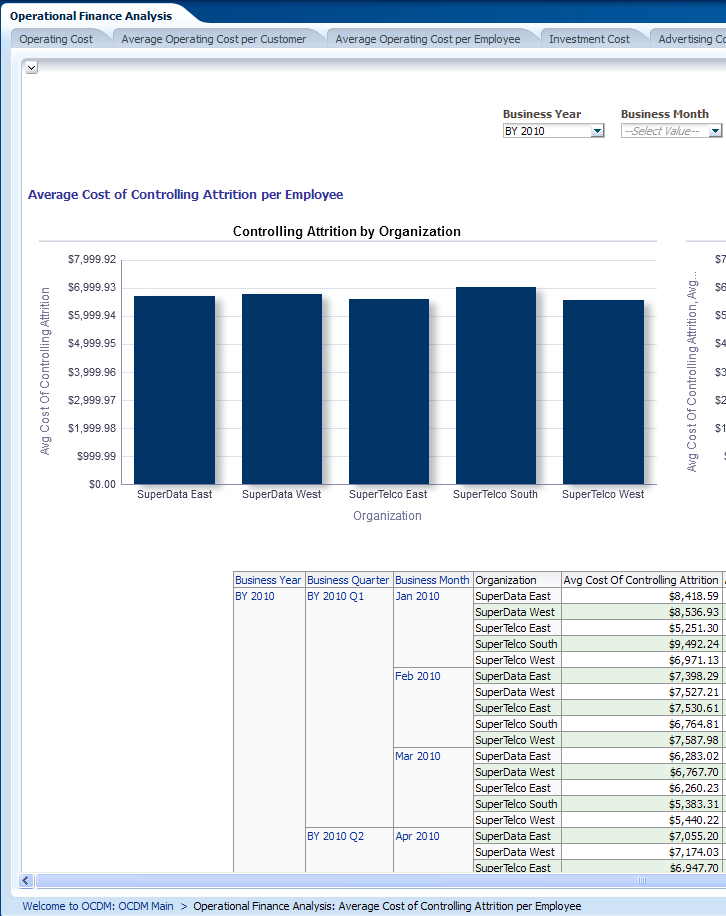

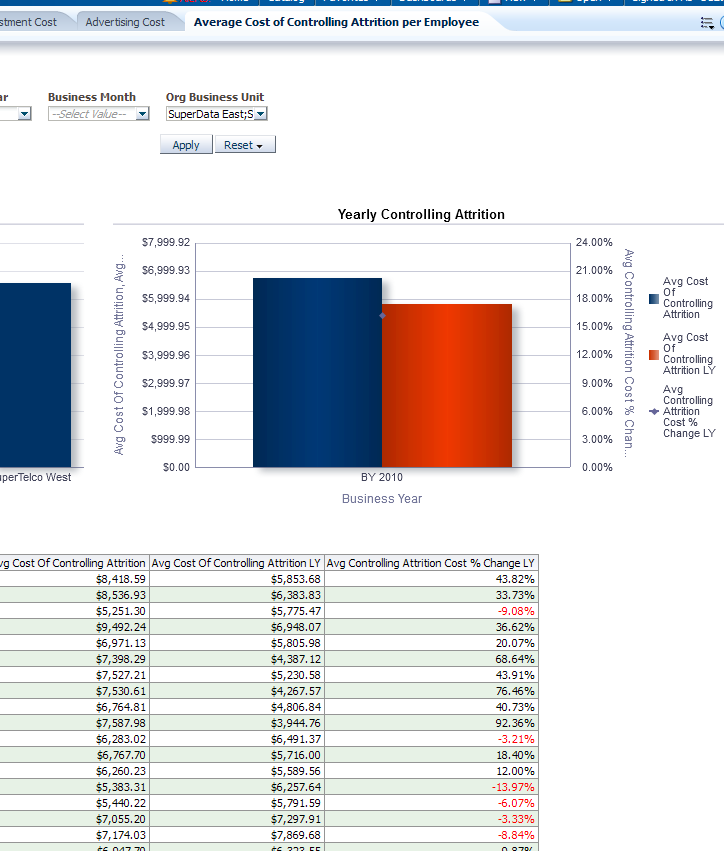

This report, as shown in Figure 12-81 and Figure 12-82 provide the current year Level "Controlling Attribution by organization" and "Yearly Controlling Attribution" information based on "Organization" which can be compared with last years metrics like LY and % Change LY.

The attrition cost should be defined by the service operator.

Report dimensions are:

Business Time

Organization

Product

Figure 12-81 Average Cost of Controlling Attrition per Employee (left side of screen)

Figure 12-82 Average Cost of Controlling Attrition per Employee (right side of screen)

This area includes the reports: Total Profit, Average Profit per Customer, and Average Profit per Employee.

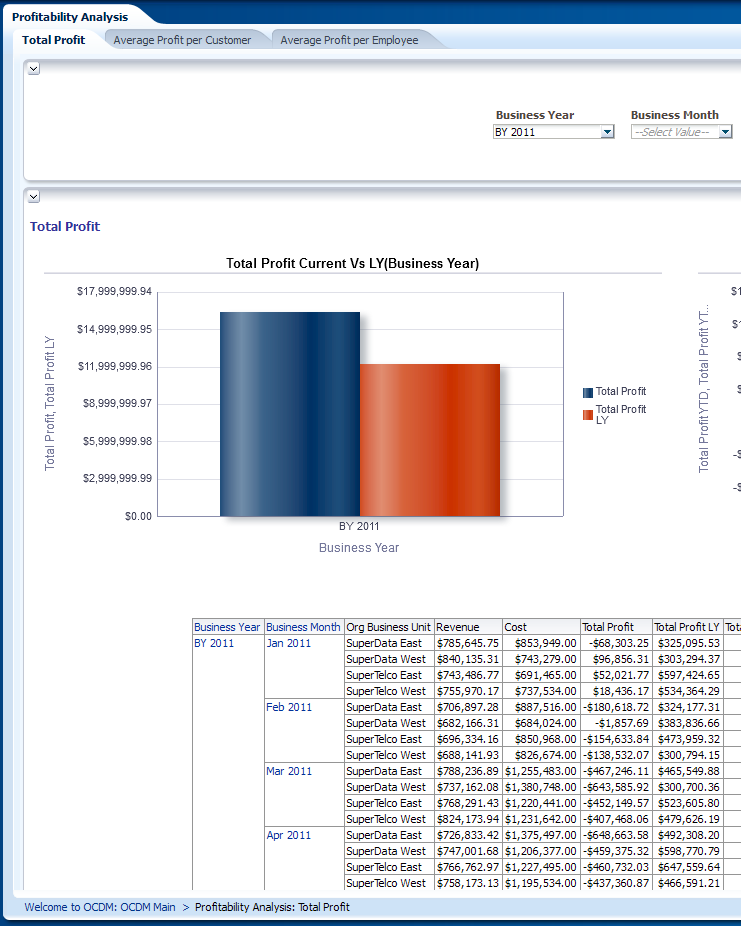

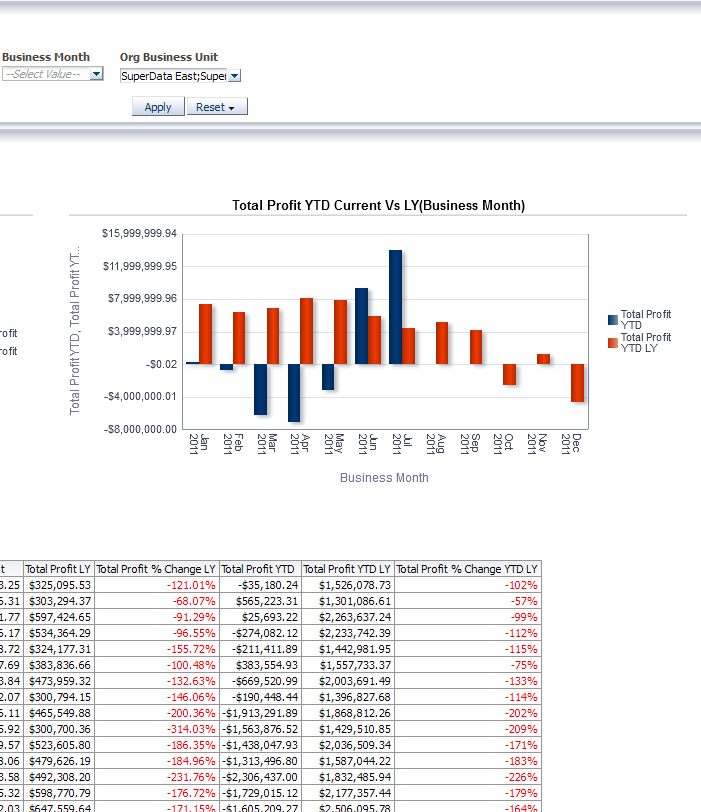

This report, as shown in Figure 12-83 and Figure 12-84 provide the current year and month-level "Total Profit" information based on "Organization" which internally can be compared with last years metrics like LY,% Change LY, YTD, YTD LY, YTD % Change LY.

Report dimensions are:

Business Time

Organization

Figure 12-83 Total Profit Report (left side of screen)

Figure 12-84 Total Profit Report (right side of screen)

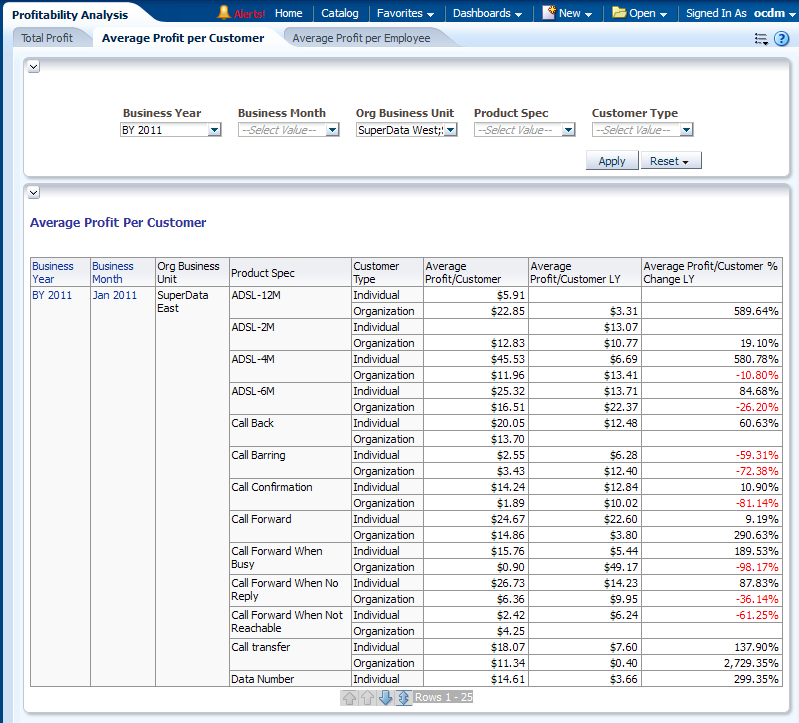

This report, as shown in Figure 12-85 provides the current year and month-level "Average Profit" information based on "Customer" and "Customer by Product" which internally can be compared with metrics such as LY, % Change LY for last year.

Report dimensions are:

Business Time

Organization

Product

Customer Type

Figure 12-85 Profit: Average Profit per Customer Report

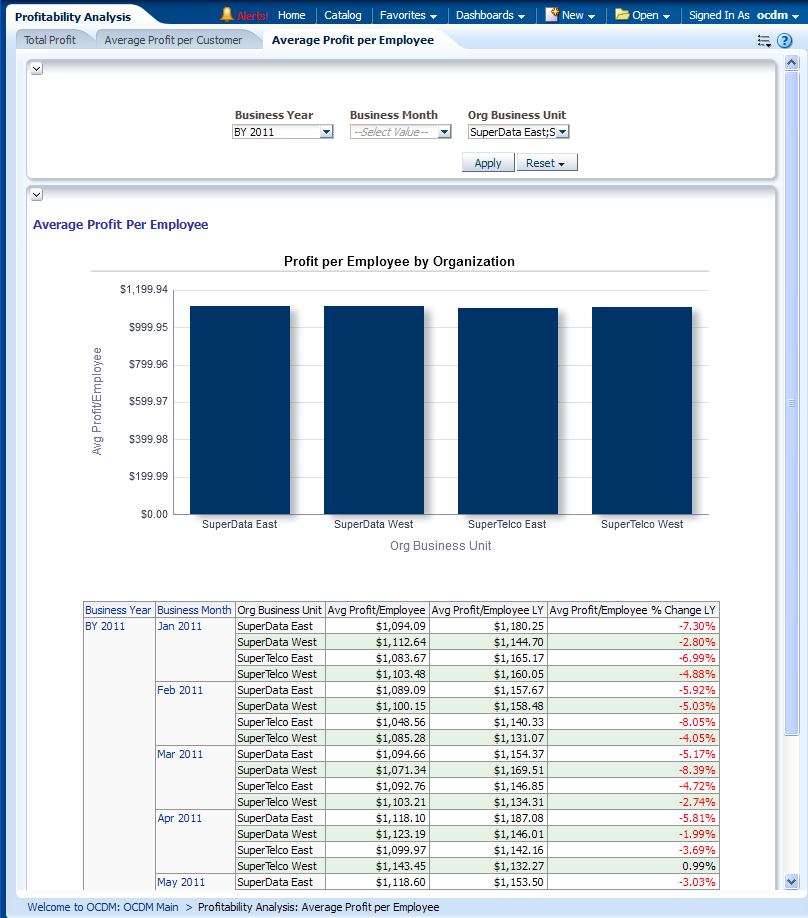

This report, as shown in Figure 12-86 provides the current year and month-level "Average Profit" information based on "Employee" and "Org Business Unit" which can be compared with last years metrics like LY, % Change LY.

The average profit is calculated by dividing the total profit by the number of employees.

Report dimensions are:

Business Time

Organization

Product

Customer Type

Figure 12-86 Profit: Average Profit per Employee Report

The partner management reports include the following areas:

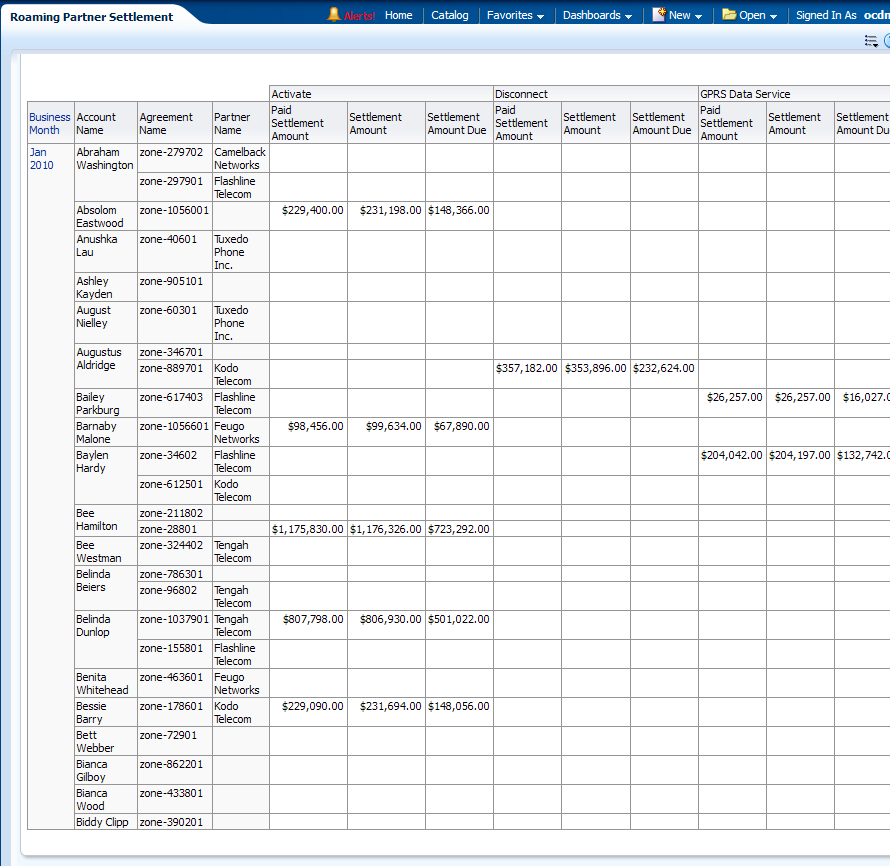

This area includes the report Roaming Partner Settlement Summary.

This report, as shown in Figure 12-87 provides month-level transaction activity information based on partner settlement measures, for one or more location. This report shows summary over financial settlement activities happened to partners.

Report dimensions are:

Business Time

Geography

Billing Cycle

Event Type

Account

Party

Contract

Figure 12-87 Roaming Partner Settlement Summary Report

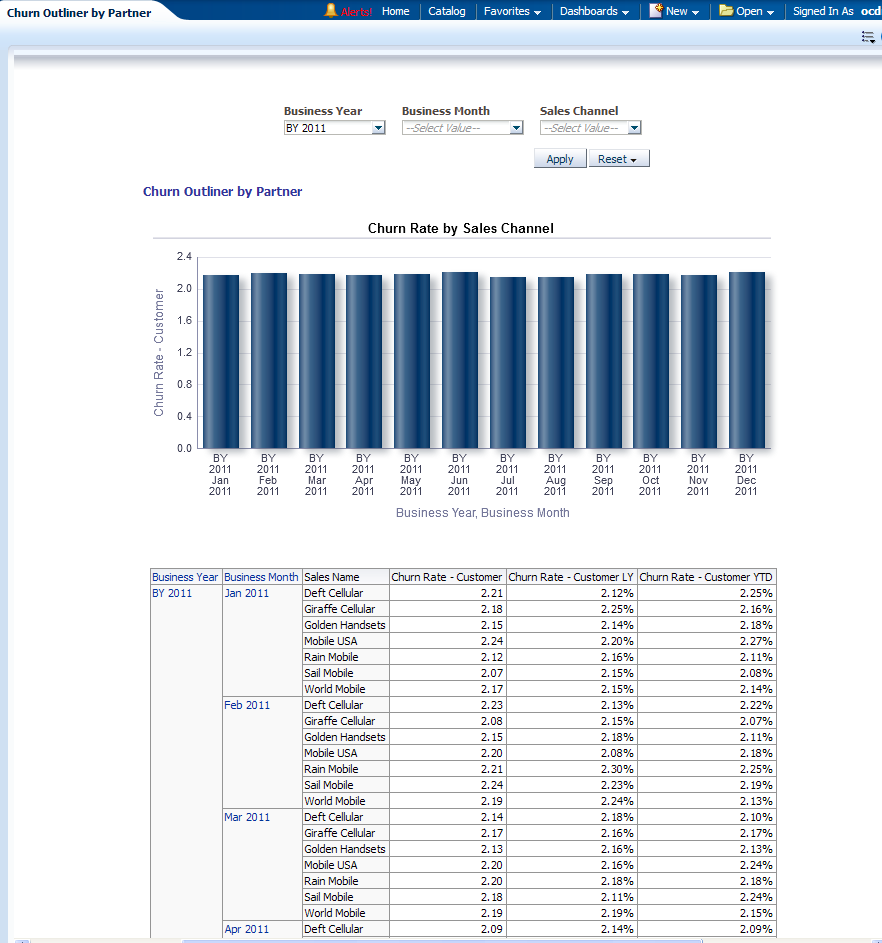

This area include the report: Churn Outliner by Partner and Track Dealer Commission and Performance.

This report, as shown in Figure 12-88 provides year-level transaction activity information based on average churn rate for customer measures, for one or more sales channel.

This demonstrates statistically significant anomalies in churn rate by sales channel or partners (for example which channel records maximum churn) This can help identify problem area domains and facilitates further drill down to identify the cause of the problems (network problems and other problems) and take remedial actions to prevent churns. Actions could be further training or education to the partners, empowering them to offer additional incentives or discounts.

Report dimensions are:

Business Time

Sales Channel

Figure 12-88 Churn Outliner by Partner Report

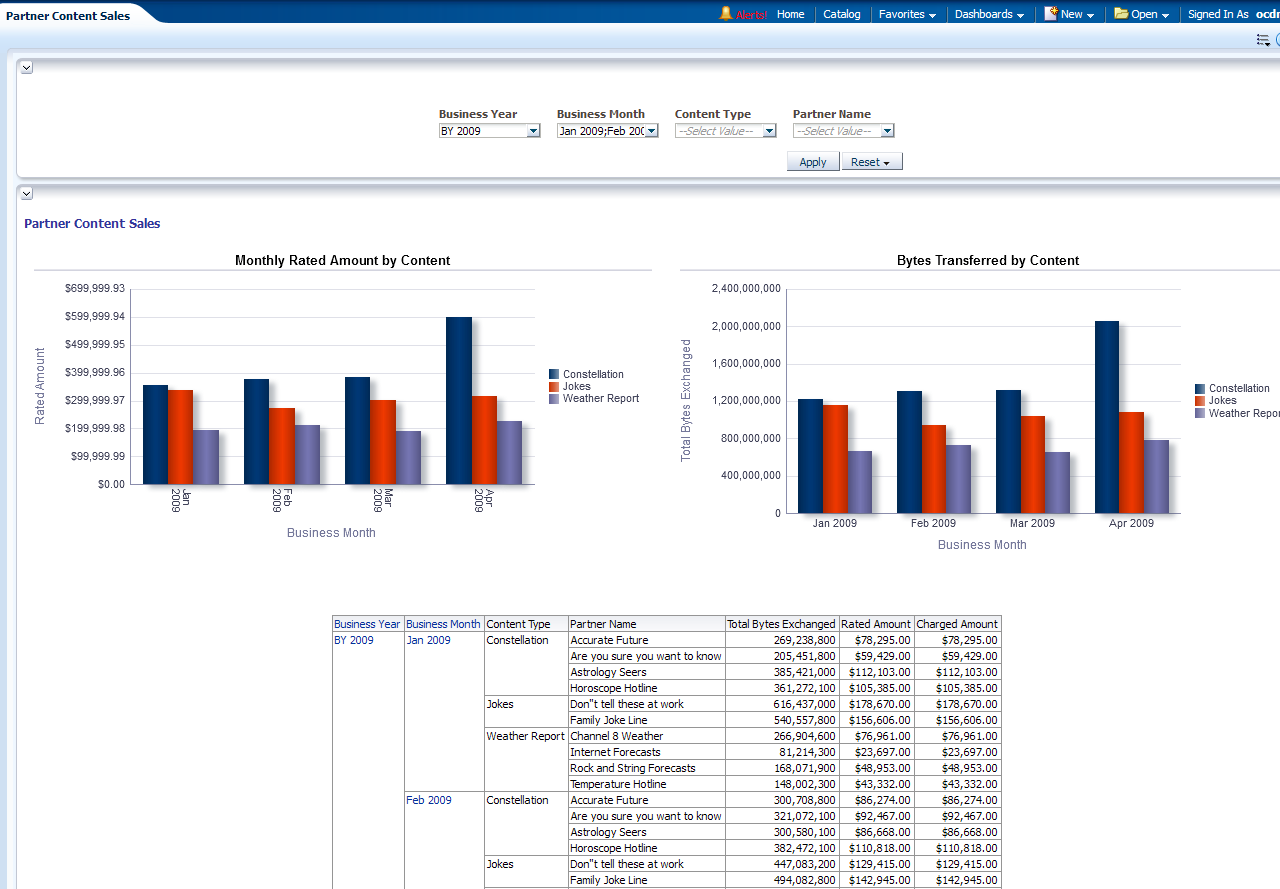

This area includes the report Partner Content Sales.

This report, as shown in Figure 12-89 provides month-level transaction activity information based on data usage measures, for one or more content.

Report dimensions are:

Business Time

Content Type

Figure 12-89 Partner Content Sales Report

This area includes the report: Track Dealer Commission and Performance.

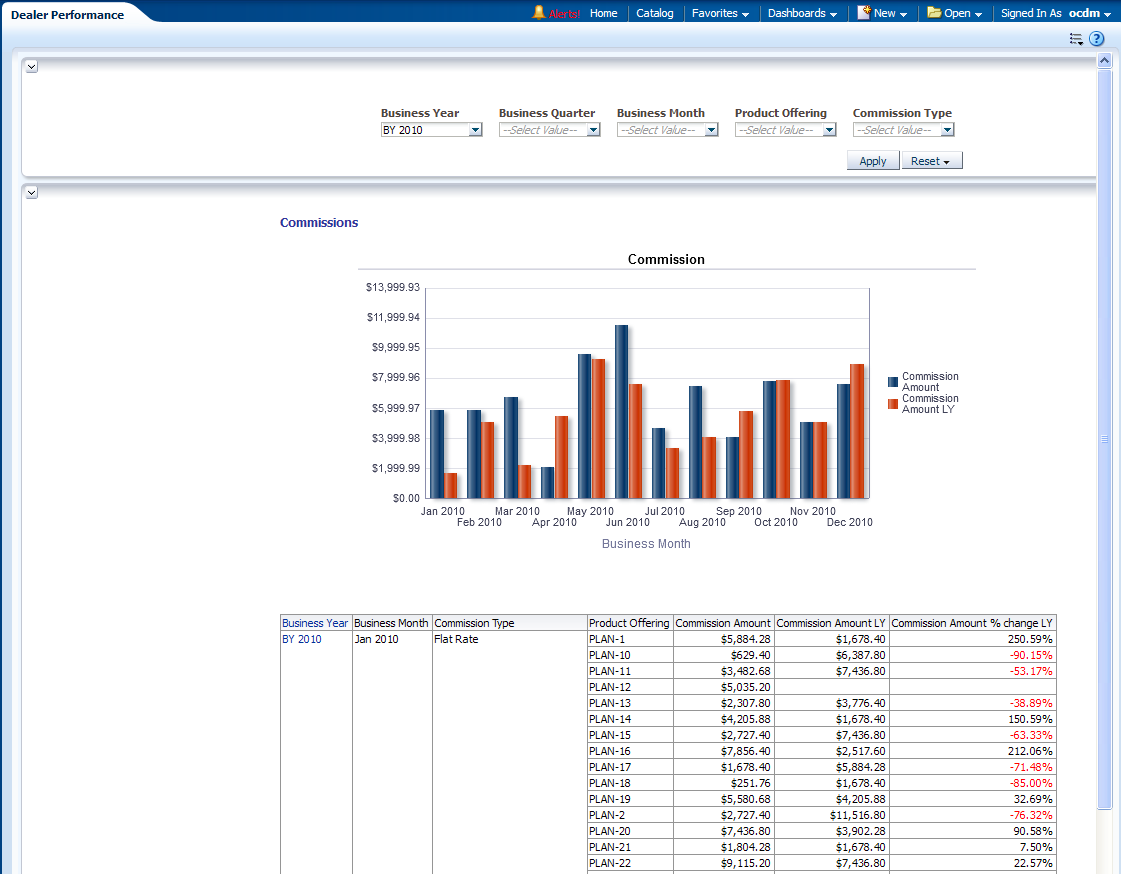

This report, as shown in Figure 12-90 gives the month level Dealer performance and commission generated based on a product.

Report dimensions are:

Business Time

Commission Type

Product

Figure 12-90 Track Dealer Commission and Performance Report